- Chapters

-

Chapter

5

Sections - Chapter 5 Executive Summary

- Chapter PDF

Chapter 5

Quick Links

Chapter 5

Resource Allocation

Resource Allocation is a key component of TAM. This chapter describes the resource allocation process and provides guidance on implementing a resource allocation process that makes the best use of asset data and systems to allocate scarce resources in a timely manner in support of TAM-related goals and objectives.

Section 5.1

Resource Allocation and Prioritization Process

Resource allocation is an interconnected process of decisions about how to allocate funds to different assets, often driven by legal requirements or a desire for better accountability. DOTs face a variety of constraints when trying to manage their assets, which makes it especially important to apply rigorous, data-driven methods when making long-term choices.

Section 5.2

Cross-Asset Resource Allocation Methods

The resource allocation process described in Section 5.1 can be applied to a specific asset type, or to multiple types of assets or investments. However, there are many challenges organizations face when making decisions about investments considering multiple types of assets and types of investments. Two basic approaches for helping determine how to allocate resources across asset types are defining performance targets and developing a structured prioritization process that quantifies achievement of multiple objectives.

Section 5.3

Financial Planning

A TAM financial plan describes the sources of an organization’s funds and how funds will be used over time on TAM activities. Resource allocation and TAM financial planning are closely linked activities. TAM financial planning both contributes to the resource allocation process and uses its results.

Section 5.4

Work Planning and Delivery

Investments are conceived and delivered in many different ways. The different models used for work planning and delivery have an impact on the resource allocation approach.

Section 5.5 NEW SECTION

Asset Valuation

Asset value is an important piece of financial reporting and TAM. It can be used in financial statement balance sheets, it communicates what an agency owns and maintains, and it supports investment decisions. Financial reporting standards and requirements dictate how to perform the calculations; however, in practice, there is no single correct way to measure an asset’s value.

Note: This section was derived from the web version of NCHRP Web-Only Document 335: A Guide to Computation and Use of System Level Valuation of Transportation Assets. More detailed information is available in this NCHRP Report. A summary is provided below to provide an overview and context.

Resource Allocation and Prioritization Process

Resource allocation is an interconnected process of decisions about how to allocate funds to different assets, often driven by legal requirements or a desire for better accountability. DOTs face a variety of constraints when trying to manage their assets, which makes it especially important to apply rigorous, data-driven methods when making long-term choices.

- Chapters

-

Chapter 5

Sections - Chapter 5 Home Page

- Chapter PDF

Chapter 5

Quick Links

5.1.1

What is Resource Allocation?

In the context of TAM, resource allocation is the process of assigning scarce resources to investments in transportation assets. The assigned resources can be money, staff time, contractor capacity, equipment, or anything else that an organization requires for its assets. The investments can be capital projects, maintenance efforts, or other projects and activities that require the use of an organization’s resources through various delivery methods.

To the extent an organization is focused on preserving its existing transportation assets, ideally it will make investments consistent with the life cycle management approach for its assets as described in Chapter 4. However, organizations often lack the funding, staff, or other resources needed to achieve all of their goals and objectives, and must make hard decisions about how to divide resources while considering competing needs. If resources for existing assets are systematically constrained such that the life cycle management approach is simply not achievable, the resource allocation process may need to revise life cycle strategies or the overall life cycle management approach.

The approaches used for resource allocation vary. For instance, in considering how to allocate capital funding over multiple years, an organization may need to either prioritize projects or establish an overall budget for certain types of investment, depending on the specific context. In day-to-day allocation of operations and maintenance resources, the challenge is more tactical, as a manager assesses what staff, materials and equipment are immediately available, considers both internal forces and contract capacity, and puts these to the best possible use considering current conditions and challenges.

The output of the resource allocation process could be a specific assignment of resources or a plan for what capital projects to fund. In addition, the results of the resource allocation process may impact other plans and decisions related to TAM. To the extent the process involves allocating money, a financial plan may serve both as an input to the process (by specifying what funds are available) and an output of the process that details how funds will be spent. TAM financial planning is discussed further in Section 5.3.

Once an initial set of resource allocation decisions has been made, an organization may need to reconsider the best delivery option for planned work. Issues related to work planning and delivery are discussed further in Section 5.4.

All organizations practice resource allocation in some manner, whether formally or informally. By using a structured and repeatable approach for resource allocation, an organization improves its own resilience and ensures that it will continue to succeed even as new challenges arise and personnel changes over time. This chapter outlines an idealized approach to resource allocation an organization can use to help assess how it allocates resources, and how best to improve its process.

It also describes various processes closely related to resource allocation, such as risk management, financial planning and work planning and delivery.

- Chapters

-

Chapter 5

Sections - Chapter 5 Home Page

- Chapter PDF

Chapter 5

Quick Links

5.1.2

Transportation Agency Context

For U.S. transportation agencies, the resource allocation process is influenced by the set of legislative and regulatory requirements related to transportation planning and programming.

Since the early 1970s, U.S. Metropolitan Planning Organizations (MPOs) and state Departments of Transportation (DOTs) have been required to develop long-range transportation plans (LRTPs). These plans establish the goals and objectives of an agency and detail its high-level investment plan (not necessarily listing specific projects) over a period of at least 20 years.

Requirements initiated by MAP-21 further specify that an LRTP should be performance-based, detailing forecasted performance using a set of federally specified performance measures, and additional “locally significant performance measures” if desired. These measures include summaries of good/fair/ poor condition for National Highway System (NHS) pavements and bridges. MPOs include performance measures and targets in their LRTPs. State DOTs have additional requirements to report shorter-term performance targets in different areas, including two- and four- year targets for NHS pavement and bridge condition.

In addition to developing LRTPs, MPOs and state DOTs are required to develop investment plans: each MPO develops a Transportation Improvement Program (TIP), while each state DOT develops a Statewide TIP (STIP). A TIP or STIP is a four-year (or more), fiscally constrained program of projects, including those that use federal funds (with some exceptions), additional “regionally significant” projects, and other projects the agency wishes to include. Because TIPs and STIPs are fiscally constrained, an agency must project its available revenue for the investments (typically capital) covered by the program over a period of at least four years, and many agencies have developed revenue projection models extending further into the future to support longer-range planning.

Beginning in 2018, again as a result of MAP-21, state DOTs are required to prepare TAMPs addressing pavements and bridges on the NHS at a minimum, while potentially including other asset classes and road systems. An agency’s TAMP describes the asset inventory and its conditions, how assets are managed over their life cycles, and a 10-year financial plan for how to best maintain assets in a “desired state of good repair.”

The various plans and programs cover different time periods and are intended to comply with different requirements. However, all of them may impact the resource allocation process, particularly with respect to allocation of funding for capital projects.

TIP

Information gathered and data analyzed in the TAM process should inform resource allocation decisions that agencies document primarily in their LRTPs, TIPs, or STIPs. This is where integration and collaboration with planning and programming groups within the agency is essential.

While these requirements are specific to the U.S., other countries have established their own planning and programming requirements, resulting in different—though frequently analogous—impacts to their resource allocation processes. Lessons learned from asset management experience in the U.S. and abroad include:

- In some cases organizations have implemented asset management programs and prepared asset management plans in response to legal requirements, while in others efforts to implement asset management concepts have been motivated by a desire to improve decision-making. While it is difficult to generalize, it appears that jurisdictions that adopt asset management planning by choice tend to realize the benefits much more quickly, improve service delivery, and allocate resources more effectively.

- Alignment of resource allocation to achieve goals and objectives is very important to ensure an agency advances from a traditional maintenance management approach, in which targets for asset conditions result from the available budget, to a performance-based approach in which an organization’s goals and objectives help define the required level of service (LOS) for its assets, which in turn drives resource allocation decisions.

- Organizational goals ideally should not focus on assets, or their condition, but the outcomes that are desired, such as improved mobility, safety and infrastructure resilience. Changing technology (CAV, communications), social (graying populations, work from home patterns, ridesharing), economic (integrated transportation modes), may be very relevant to how resource allocation should be conducted. Agencies that make resource allocations based largely on the condition and life cycle strategies of only the existing portfolio, may face greater challenges achieving their goals, and adapting to the changing needs of their economies

- International, and US DOT agencies that have focused resource allocation on their goals and objectives, rather than on the existing assets they are responsible for, tend to be more readily able to leverage alternative service delivery models that may present service enhancement or cost saving opportunities. These agencies agree that “We don’t need to build it or own it or maintain it, to deliver mobility.”

Washington State DOT

Washington State DOT has worked closely with its legislature to adopt asset management based resource allocation policies.

The following is an excerpt from state legislation that was last updated in 2002:

”deficiencies on the state highway system shall be based on a policy of priority programming having as it’s basis the rational selection of projects and services according to factual need and an evaluation of life cycle costs...”

– RCW 47.05.010

This legislation along with good business practices has made Washington State DOT have one of the most mature asset management practices and an integrated set of tools, business processes, and organizational culture to support good asset management.

- Chapters

-

Chapter 5

Sections - Chapter 5 Home Page

- Chapter PDF

Chapter 5

Quick Links

5.1.3

Prototypical Resource Allocation Process

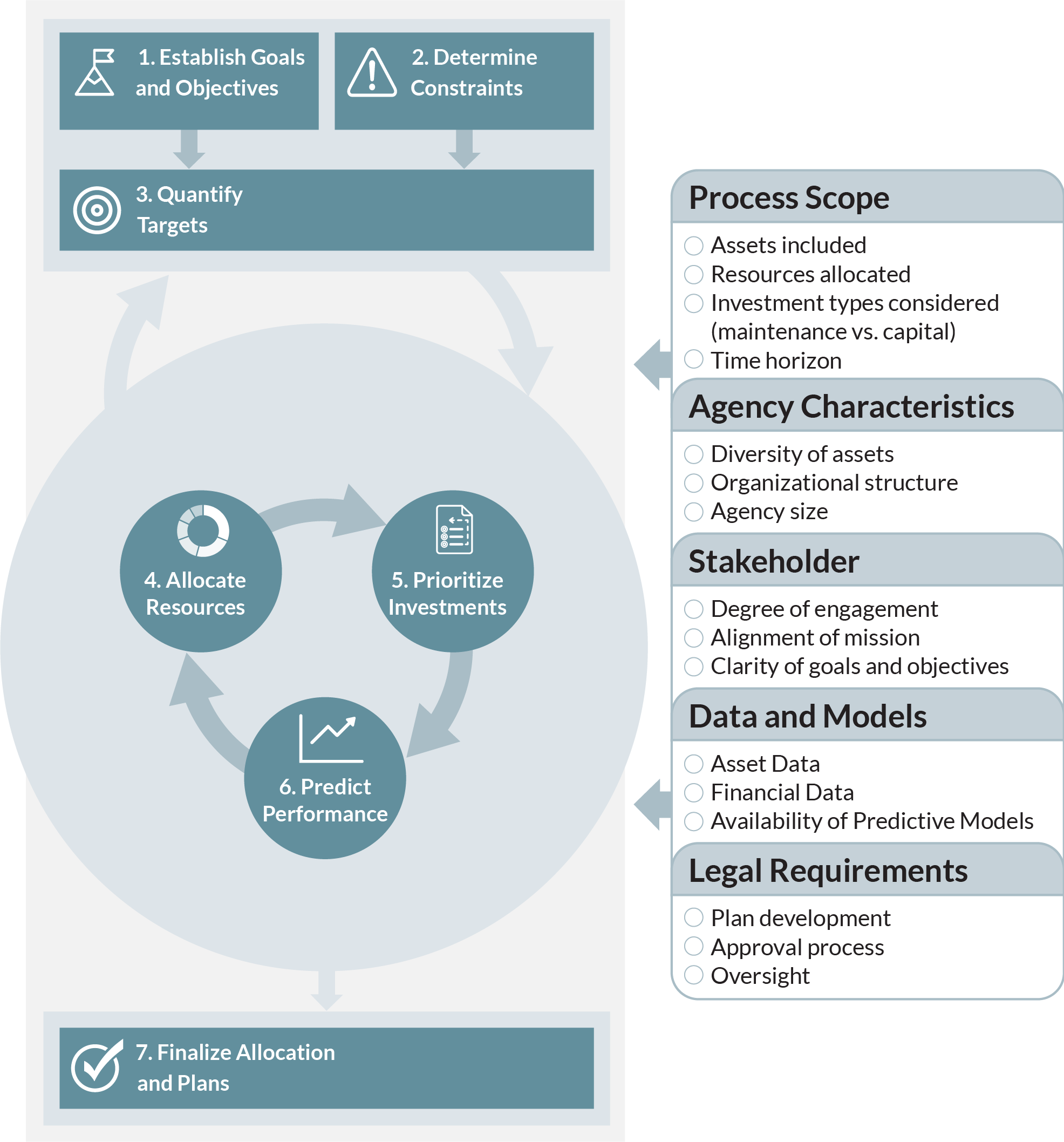

The basic resource allocation approach includes seven basic steps. Specific approaches to resource allocation differ depending on where resources are being allocated and the organizational context.

This section describes a basic resource allocation process. The resource allocation process can be used to answer three key questions:

- What resources are required and how should they be distributed over time to best meet the long-term goals and objectives?

- What performance targets are achievable given available resources?

- How should resources be used in the short term to best support the goals and objectives?

The details of the process differ depending on what resources are being allocated to what investments, the timeframe and the particular circumstances faced by the organization.

A generic process is presented here as a framework for assessing the different allocation processes used by different organizations, as well as to help structure the discussion of issues related to resource allocation presented in subsequent sections of this chapter. The process is iterative; it is frequently necessary to walk through the process in order to establish a proposed allocation, review the proposed solution, and then revisit the assumptions made earlier, altogether resulting in a revised outcome.

TIP

Almost all agencies already have structured resource allocation processes; introducing TAM or improving TAM practice should begin with assessing existing processes to identify areas where asset-related data and TAM process analysis outputs (e.g. life cycle planning outputs) can be incorporated.

In applying the prototypical process, it is important to consider that organizations typically have different resource allocation processes for allocating different resources over different time periods. The basic steps in the process are the same regardless of the specific context, but the details of how each step is performed may vary.

For example, in considering how to allocate resources over a period of 10 years or more, an organization might consider what funding is needed and how best to allocate funds across multiple investment categories while setting aside decisions about specific projects. In this case, the key resource being allocated is money, and the emphasis of the process will be on Step 1 – Establish Goals and Objectives and 3 – Quantify Targets. Further, in this case there may be less emphasis on Step 2 – Determine Constraints, and the prioritization performed in Step 5 may yield identification of high-level priorities rather than a prioritization of specific projects.

On the other hand, when considering how best to use staff resources and materials to perform maintenance work in the short term (less than one year), the organization would apply the process differently. In this case, the resources being allocated would include time and materials. The emphasis on the process will be on Step 2 – Determine Constraints, Step 5 – Prioritize Investments, and Step 7 – Finalize Allocation and Plans. In this case the specific allocation may not have a significant impact on the goals and objectives established in Step 1, and the prediction of future performance in Step 6 is less relevant than in the case of a longer-term allocation.

The practice examples in this section show how agencies have implemented this basic process to address different resource allocation challenges.

TIP

Although a generic framework for resource allocation is presented, agency context and other factors (e.g. legal requirements) will create the need for agencies to allocate resources in different ways.

Michigan DOT

Michigan DOT recently introduced principles of performance-based contracting to their routine highway maintenance delivery. The focus of this initiative was on developing a better understanding of performance, providing more consistency of service, encouraging innovation adoption and identifying efficiency opportunities.

To achieve this MDOT developed performance measures for 23 non-winter maintenance activities. They then examined how these activities contributed to the objectives and community outcomes MDOT wanted to achieve (e.g. safety, reliability, economic benefit, and quality of life) and used that analysis to select six initial key measures for which targets were set to focus the effort. The performance monitoring system helped one MDOT region identify unsealed shoulders (ensuring they are even and traversable) as an area requiring improvement. They invested in additional shoulder maintenance in 2015 and from this realized a performance increase of more than 30%.

MDOT is using this performance monitoring approach to better understand the cost of improving its maintenance level of service. The agency is also identifying specific resources to focus in areas where it can achieve a more consistent and safer outcome.

Southland District Council (New Zealand)

Southland District Council (SDC) manages one of the largest road networks in New Zealand. Dairy farming is critical to the economy of the local area and more broadly to the Country (SDC generates 10% of New Zealand’s dairy exports). In the period 2000-2010 there had been significant expansion of the dairy farming industry and further expansion was likely. Maintenance and renewal costs were estimated to increase significantly and SDC’s road rates were already among the highest in the country. SDC recognized that a new approach was necessary and they could not keep doing things the same way.

SDC developed the Economic Network Plan as an asset management approach that allowed SDC to determine where investment in the network would provide the greatest financial return to the community. The Economic Network Plan considered the following services provided by the network:

- Safety

- Road Condition (Levels of Service)

- Enable Exports

- Service Delivery

- Customer Quality

Consideration of the resources required to maintain the network led SDC to the decision that its highest volume roads would be maintained to its then-current LOS standard. These roads represented 20% of the road network but carried nearly 70% of the traffic. The remaining 80% of the network would have a reduction in standard over time. The Economic Network Plan provided the basis for this change.

Like many agencies, the SDC was forced to take a different approach when financial constraints required change. It enabled all parties to focus on:

- Shifting from ‘Engineering’ to ‘Customer Service Network Management’ (why the service is provided)

- Managing customer expectations proactively rather than reacting to them

- Making safety a priority

- Investing in technology and information to understand, manage and integrate with HCV operators

Source: https://www.nzta.govt.nz/assets/Road-Efficiency-Group-2/docs/southlandnetworkplan.pdf

Note: For more information on this example, see the case study on the SDC’s experience in the International Infrastructure Management Manual (IIMM).

South Dakota DOT

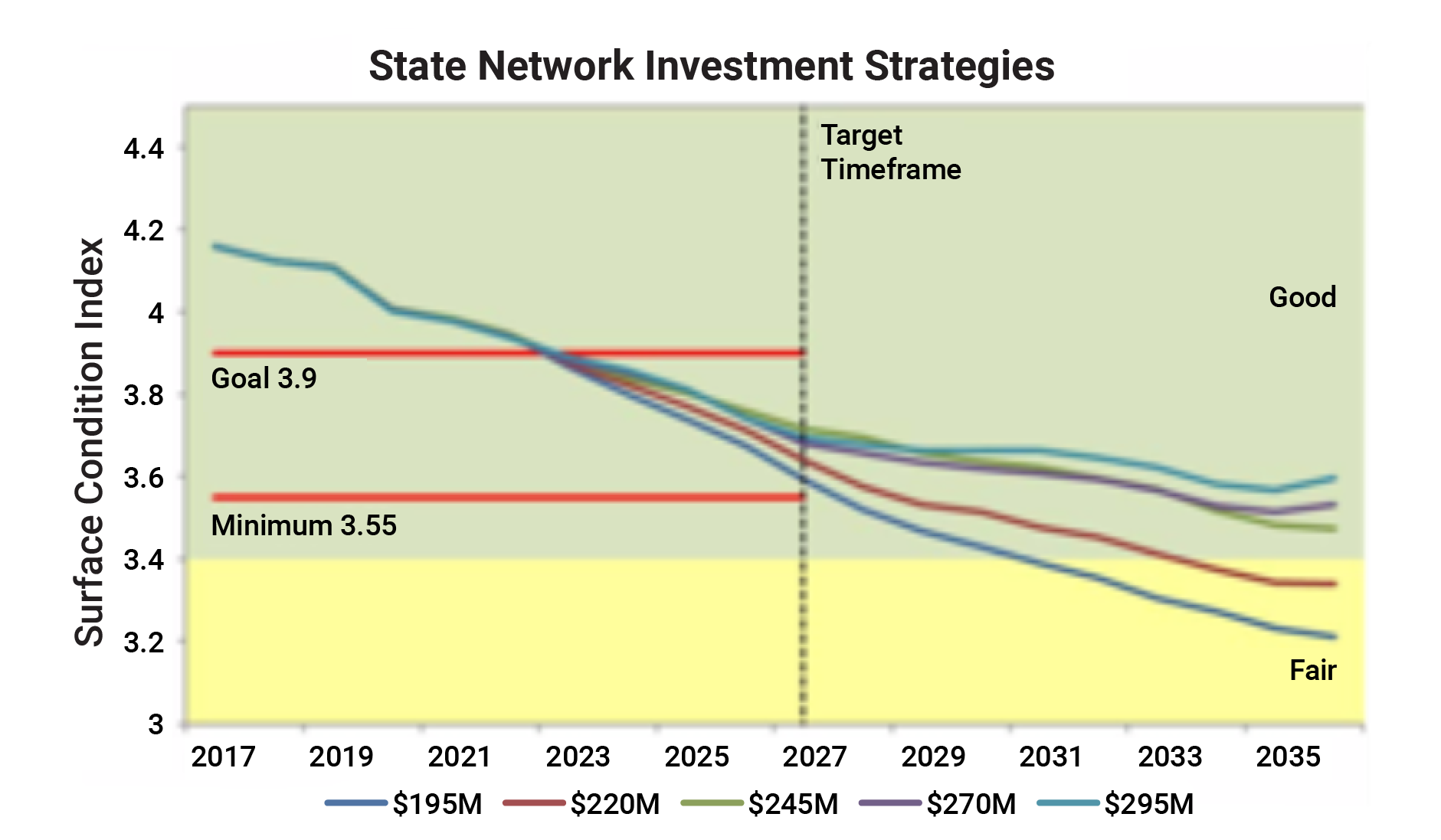

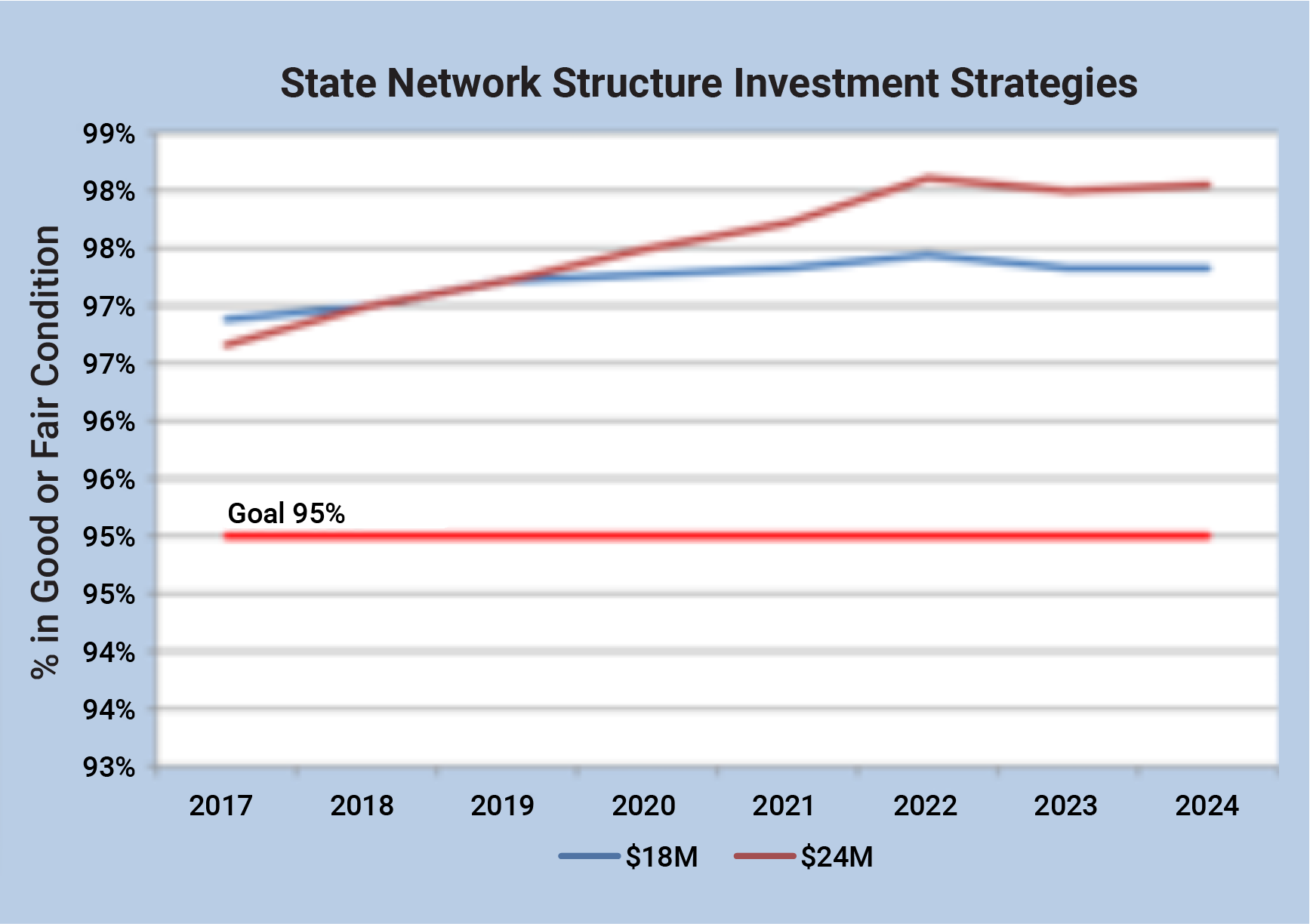

SDDOT’s agency mission is “to efficiently provide a safe and effective public transportation system.” To support this high-level goal the agency sets ten-year objectives for its pavements and bridges, as well as a minimum acceptable condition for pavements. For pavements SDDOT summarizes conditions using Surface Condition Index (SCI), a composite measure represented on a scale from 0 (worst condition) to 5 (best conditions) that incorporates measures of roughness, rutting, faulting and distress indices. For bridges, SDDOT summarizes conditions based on the percentage of structures in good or fair condition, using the FHWA good/fair/poor measure for classifying the condition of a bridge.

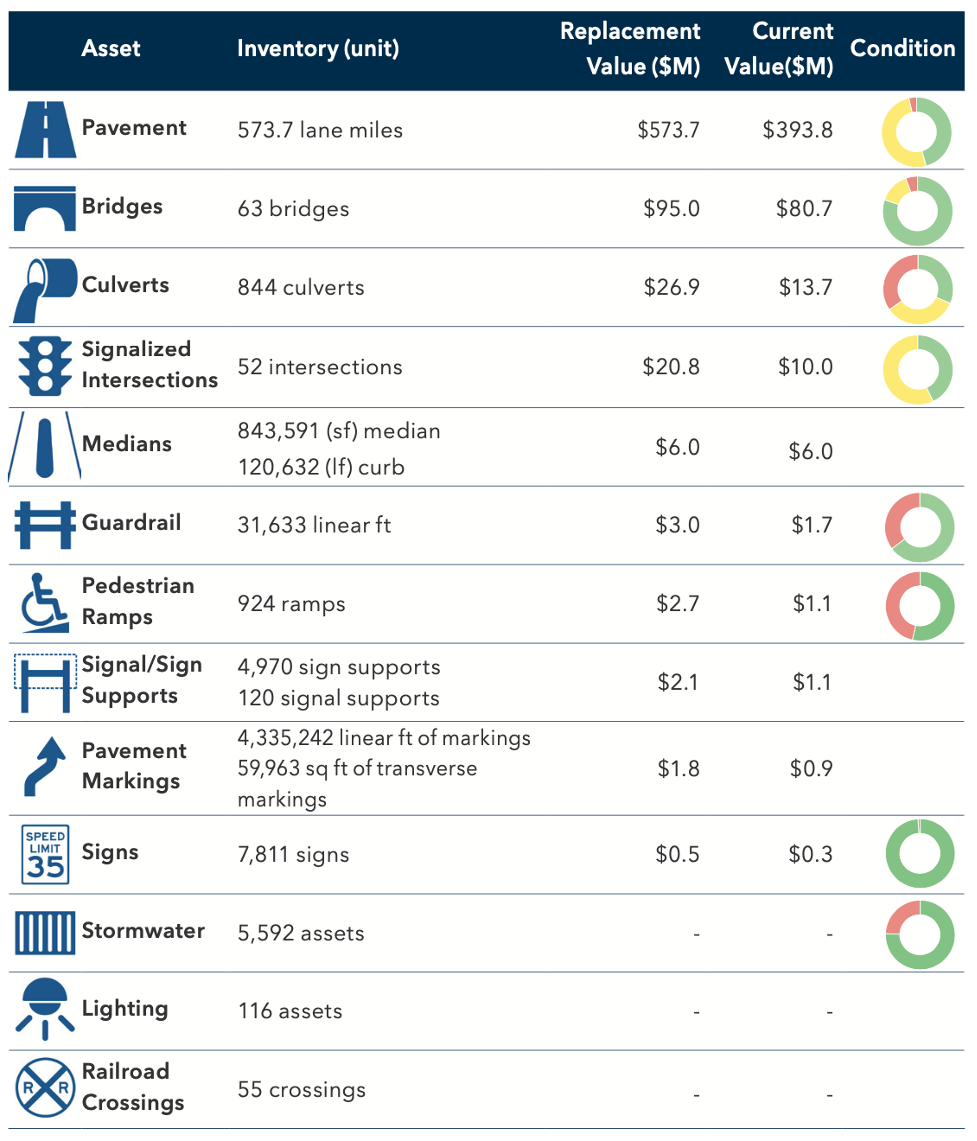

To determine how to allocate capital funds for state-owned pavements and bridges SDDOT relies heavily on its pavement and bridge management systems. The agency predicts conditions for a 10-year period for a range of different budget levels, and then compares the predicted performance to the agency’s goals and objectives. The figures, reproduced from SDDOT’s 2018 TAMP, show results in terms of predicted SCI over time for five budget scenarios generated using SDDOT’s Pavement Management System (PMS), and results in terms of percent of bridges in good or fair condition for two budget scenarios generated using the agency’s Bridge Management System (BMS).

Given the projections as well as additional projections of pavement condition for six functional systems, the agency uses its Trade-Off Tool to evaluate the impact of different funding scenarios and recommends the funding distribution that will produce the greatest benefit. The final result of the analysis is a distribution of funding between asset type and functional system, as well as the distribution of funds between four types of work:

- Construction and Reconstruction

- Resurfacing and Asphalt Surface Treatment

- Rehabilitation and

- Safety

Decisions about what capital projects to perform are then made given the funding level established in the trade-off analysis.

Source: SDDOT Transportation Asset Management Plan. 2018.http://www.sddot.com/resources/reports/SDDOT2018TAMPFHWASubmittal.pdf

State Network Investment Strategies

State Network Structure Investment Strategies

There are Seven Basic Steps in the Resource Allocation Process

- Establish Goals and Objectives. The mission, vision and broad agency goals are meant to guide decision-making across an organization. Goals and objectives may be articulated in an organization’s LRTP and/or TAMP. Ideally, the resource allocation process should support achieving these.

- Determine Constraints. Establish what resources must be allocated, and what the constraints on them are. Typically this will include constraints on available funds, but may include constraints on staff, contractor capacity, equipment, materials, or other resources. Further, there may be other constraints relevant to the process, such as constraints to distribute funds equitably between different regions or areas, or constraints on exactly how certain resources can be used.

- Quantify Targets. Translate goals and objectives into specific criteria for supporting allocation decisions. Where feasible, define performance measures that quantify the level of achievement. Set target values for key measures and establish a target level of service as discussed in Section 5.4.

- Allocate Resources. Split the budget and other resources to the set of program categories or types of work. The allocation specifies the distribution of resources between different categories or work types. The details of how this step is performed are dependent on the details of the resources being allocated, assets being analyzed, and types of investments under consideration.

- Prioritize Investments. Determine what specific investments to make given the overall allocation of resources. This determination may be made within an asset class, across asset classes or across asset management and other investment objectives (e.g. safety or mobility) depending on how the process is structured. The prioritization should maximize achievement of the organization’s goals and objectives as quantified using the measures and targets set in Step 3 subject to the constraints established in Step 4.

- Project Performance. Predict future performance given the assumed allocation and priorities, and compare the predicted performance to previously established targets. This may result in revisions to the constraints, targets or outcomes of other steps described above. To the extent that the targets are set for asset conditions, use the life cycle analysis methods described in Chapter 4 to predict future asset condition.

- Finalize Allocation and Plans. Once allocation is complete, document the resulting targets, projections and investment priorities and communicate these to stakeholders. Further work may be required following completion of the formal process, such as developing maintenance plans based on the set of approved projects.

Factors Impacting the Resource Allocation Process

The specifics of how an organization can and should approach resource allocation depend upon a number of different factors. Understanding these factors is key in developing a successful approach to resource allocation.

- Chapters

-

Chapter 5

Sections - Chapter 5 Home Page

- Chapter PDF

Chapter 5

Quick Links

5.1.4

Consideration of Risk in Resource Allocation

Uncertainty and risk complicate the resource allocation decision-making process. Risk management activities, including developing a risk register, are helpful in understanding and mitigating uncertainty, which in turn has implications for resource allocation.

Overview

All transportation decision-makers must contend with uncertainty. In regards to resource allocation, uncertainty is inherent in variables such as data on asset conditions and performance, future funding levels and costs, how a transportation system and specific assets will perform, and what external events or other factors may require reallocating resources. This uncertainty complicates efforts to make decisions about the future and forces agencies to be nimble so as to effectively respond to unpredictable events and evolving conditions.

In recent years, transportation and other industries have made significant progress developing improved approaches for managing uncertainty to minimize negative and leverage positive impacts. An area of focus in transportation has been in managing the risk of project cost and schedule overruns; a number of agencies have established enterprise risk management programs in order to address risk and uncertainty across their organizations. Likewise in TAM, there is increased interest in identifying and assessing risk so as to comply with both the best practices and the FHWA requirement for state DOTs to consider risk in developing their NHS TAMP.

The word ‘risk’ can be very context specific, meaning very different things depending on the industry and application. For instance, a financial analyst is primarily concerned with uncertainty in financial returns and the risk of incurring a significant financial loss. In the nuclear power industry, however, the focus of managing risk is on minimizing the potential for catastrophic loss that might occur from damage to a nuclear facility. As discussed in Chapter 2, in this guide risk is defined as the “effect of uncertainty on objectives” consistent with the ISO definition. This definition captures the full range of applications of risk management, and acknowledges the possibility for both positive and negative consequences of uncertainty.

The term ‘risk management’ is used to capture the set of business processes associated with identifying and managing uncertainty and risk. The overall risk management process is described in Chapter 2. The remainder of this section describes how this process relates to resource allocation.

Implications for Resource Allocation

While the scope of risk management may be very broad, an organization’s approach to risk management and the outcomes resulting from a risk assessment may nonetheless have important implications for TAM resource allocation. Consequently, it is important to establish a risk management approach and integrate consideration of risk with the resource allocation process.

TIP

Multi-objective decision making is a concept in operations research that is implemented in several different forms, from simple consensus-building approaches (e.g. Delphi processes) to more complex software tools. In all cases, it allows consideration of more than one factor or criteria in making a decision.

Specific possible implications of risk management on resource allocation may include, but are not limited to:

- An organization may identify through its risk management approach areas where better data or improved processes are needed to best address a given risk, in turn impacting the resource allocation process. For instance, if uncertainty concerning future asset conditions is found to be a significant risk, this may result in efforts to improve the deterioration models in an agency’s asset management systems and/or motivate data collection improvements to reduce uncertainty.

- An organization may identify specific investments of staff time and/or agency funds required to mitigate negative or leverage positive risk. Once specific investments are identified, they can be assessed along with investments in other asset/investment categories. For example, Caltrans defined a separate program for seismic retrofits as described in the Practice Example.

- If an agency’s allocation of resources hinges on uncertain future values for one or more parameters, it may be necessary to incorporate consideration of uncertainty formally in the decision-making process. This can be accomplished using Monte Carlo simulation or other quantitative approaches to establish the predicted distribution of outcomes. For instance, in performing a life cycle cost analysis to select between project alternatives for a given facility, Monte Carlo simulation can calculate the range of life cycle costs predicted depending on future values for cost escalation, deterioration, or other parameters.

- In approaching formal accounting for uncertainty, an organization may define different scenarios representing the possible range of outcomes and then determine how best to allocate resources in each scenario before establishing a preferred resource allocation approach. For example, if an agency’s future capital budget is unknown, a decision-maker may wish to define a high, medium and low budget scenario and determine what investments would be made in each scenario in order to most effectively prioritize given uncertainty. Likewise, a scenario analysis approach can be useful in assessing how to allocate resources for improving infrastructure resilience given uncertainty concerning future sea level rise. Typically, the decision maker will review results for different scenarios and make a subjective determination of how to allocate resources considering the relevant factors. The Practice Example describing the analysis of harbor-wide barrier systems for the City of Boston shows one such approach. Recent research in the area of Robust Decision Making (RDM) has focused on developing quantitative approaches to select optimal investments between different scenarios.

Caltrans

Caltrans initiated its Seismic Safety Retrofit Program in the wake of bridge failures experienced in the 1989 Loma Prieta Earthquake. Through this program Caltrans evaluated the retrofit needs for all of the over 12,400 bridges on the State Highway System (SHS). Retrofit needs were prioritized using a multi-attribute procedure that calculated a score for each bridge considering the likelihood of an earthquake at the bridge site, the vulnerability of the bridge to collapse in the event of an earthquake, and the impact of a collapse considering the traffic using the bridge and detour distance in the event of a collapse. Through 2014 the program resulted in retrofit of 2,202 state highway bridges at a cost of over $12.2 billion.

Sources:

2018 Caltrans TAMP

Practical Lessons from the Loma Prieta Earthquake (1994), p. 174-180 https://www.nap.edu/catalog/2269/ practical-lessons-from-the-loma-prieta-earthquake

University of Massachusetts

The Sustainable Solutions Lab at the University of Massachusetts Boston used a scenario-based approach to analyze the feasibility and potential risk reduction of Boston Harbor barrier systems to protect the Boston area from future flooding due to sea level rise. The report included an economic analysis in which costs and benefits were predicted for 32 scenarios considering:

- Two barrier system alternatives

- Two construction time scenarios

- Two scenarios for effectiveness of “shore-based solutions”

- Low and high construction cost estimates

- Discount rates of 3% and 7%

The analysis indicated that the benefits of the proposed barrier system would exceed their cost for both systems evaluated, but only in the case that one assumed a low discount rate, accelerated construction schedule, and failure of other shore-based solutions for mitigating sea level rise. Also, the analysis indicated that beyond a certain point sea level rise would be such that a barrier system would no longer prove effective (since the barrier would have to be closed at all times rather than only during flood events). The report further predicted costs and benefits for two alternative scenarios involving incremental adoption of a variety of shore-based mitigation approaches, and recommended an initial focus on shore-based adaption as the most promising strategy for the City of Boston to address sea level rise.

Regional Municipality of Peel (Canada)

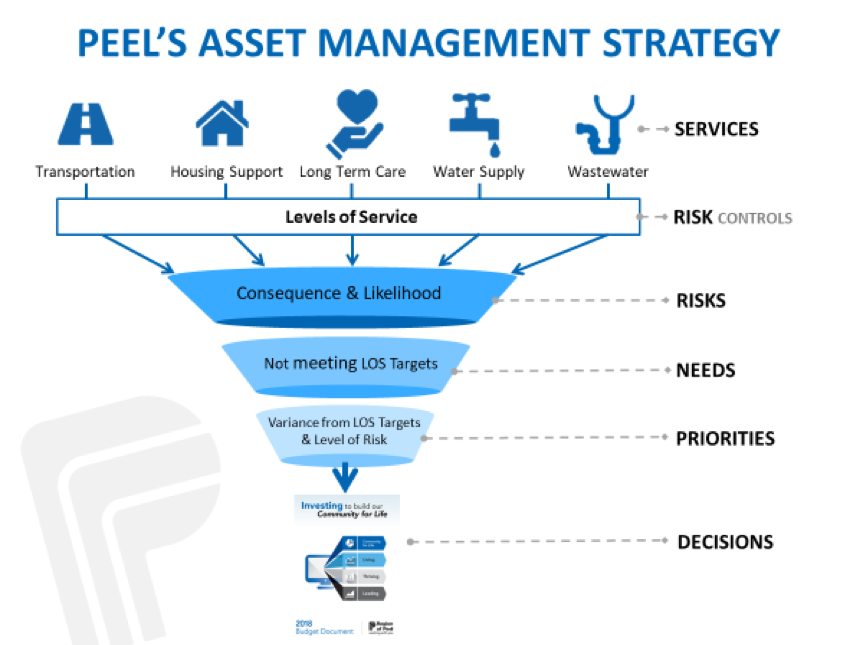

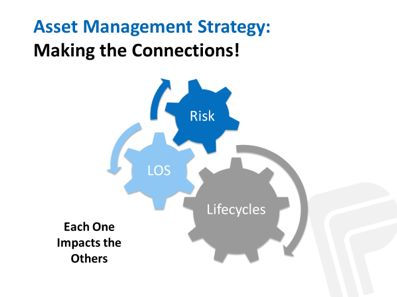

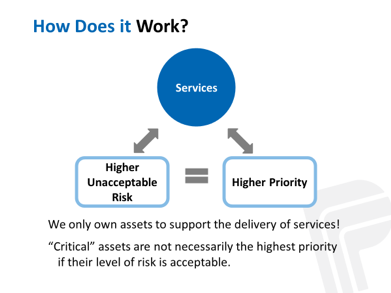

The Region of Peel is the second largest municipality in Ontario, just west of Toronto and supports two cities and a town. Peel assesses needs and priorities across a diverse portfolio of Infrastructure that supports a variety of programs and services including an arterial roads network, solid waste management, water and wastewater treatment distribution and a variety of social, health and emergency services. The Region integrated a number of inputs to enable an optimized investment methodology including a Risk Management, Level of Service, and Life cycle Management Strategies and priortize needs across diverse infrastructure, as illustrated in the figure. The integration of these three strategies was possible through three enablers and working with all of the programs and services to model their infrastructure:

- Establishing a consistent approach to quantifying risk – The Region evaluates the degree of risk that is currently being accepted associated with delivering service levels. Inherent risk (similar to asset criticality) and residual risk (the Region’s risk objective) are established and the current level of risk that an asset presents to service delivery is also determined. The gap between current and residual risk represents the unmet funding and asset needs.

- Establishing a normalized method to determine current level of service to assist the cross-asset funding allocation task. The adopted normalized indicator was determined to be: LOS=% of Assets Meeting LOS + (% of Assets Not meeting LOS x Average Condition of Assets not meeting).

- Adopting a direct relationship between LOS and risk that allows for an analysis of alternative investment scenarios, and modeling techniques to optimize investment allocation. It also allows annual infrastructure evaluation based on the most current condition information and annual Asset Management Reporting.

Peel’s risk-based approach to asset management is integrated with the Region’s Strategic Plan and the Long-Term Financial Planning Strategy, and supports the desired service outcomes by evaluating risk against the Council approved asset levels of service. This approach provides senior decision-makers an objective way to consider resource allocation alternatives and communicate in a common language when evaluating between service areas and different asset portfolios.

Peel Enterprise Asset Management Plan. 2019. http://www.peelregion.ca/council/agendas/2016/2016-04-07-arc-agenda.pdf. http://www.peelregion.ca/finance/_media/2019-enterprise-asset-management-plan.pdf

Cross-Asset Resource Allocation Methods

The resource allocation process described in Section 5.1 can be applied to a specific asset type, or to multiple types of assets or investments. However, there are many challenges organizations face when making decisions about investments considering multiple types of assets and types of investments. Two basic approaches for helping determine how to allocate resources across asset types are defining performance targets and developing a structured prioritization process that quantifies achievement of multiple objectives.

- Chapters

-

Chapter 5

Sections - Chapter 5 Home Page

- Chapter PDF

Chapter 5

Quick Links

5.2.1

Challenges in Cross-Asset Resource Allocation

Resource allocation decisions considering multiple objectives is difficult due to a variety of factors. Competing objectives, data limitations, and uncertainty complicate the resource allocation process.

In determining what work to perform across all assets, an agency is faced with the basic problem of multi-objective, cross-asset decision-making. Typically an agency must, either implicitly or explicitly, determine how to divide scarce resources between different asset types, and in so doing try to accomplish a variety of different objectives.

The basic process described in Section 5.1 is applicable whether the resource allocation process concerns a single asset or multiple assets. However, there are extra challenges inherent when dividing resources among multiple types of assets or types of investments. Making resource allocation decisions considering multiple objectives is made more difficult by a variety of challenges, including but not limited to:

Competing Objectives. Fundamentally, a transportation agency seeks to improve mobility while maximizing the safety of the transportation system, minimizing negative impacts to the environment and society, and making best use of limited funds and other resources. It is difficult to quantify these as well as other competing objectives and often hard to reach consensus on what achievements should be prioritized when determining how an agency measures the progress of different areas to support a decision.

Data Limitations. A structured approach to resource allocation requires data. Ideally, an agency has detailed, quantitative data on existing conditions, the scope of a proposed investment, and what the effects of an investment are likely to be. However, obtaining data and projecting future conditions can be costly, and the decision to proceed with an investment must sometimes be made before detailed data is available. Often it is necessary to use qualitative data or estimates in lieu of quantitative data.

Uncertainty. Transportation investments are intended to make improvements in the future, but there is always uncertainty concerning future asset and system conditions as well as how assets will perform and what external risks may impact the system.

Structuring the resource allocation process to address multiple types of assets or investments requires particular focus on two of the steps illustrated in Figure 5-1: Step 3 - Quantify Targets and Step 5 – Prioritize Investments. Different approaches to cross-asset resource allocation tend to focus on one or the other of these steps.

For instance, a process focused on defining targets is premised on the fact that most asset management systems model different asset classes separately, using different deterioration models, treatment rules and benefit calculations. Different systems and approaches are also used to analyze different types of investments. It is possible to perform separate analyses for each asset or investment type that consider what results will be obtained depending on the overall investment level or other variations in resource allocation. Decision makers can then review the results of the different analyses to determine how to allocate resources at a high level. Once an overall allocation is established, different approaches can be used for prioritizing investments by asset or investment type.

In contrast, with a process emphasizing prioritization, the focus is on identifying and prioritizing specific candidate investments. The prioritization approach helps determine which investment is most desirable considering the organization’s goals and objectives, and the predicted outcomes of the investment. In this case it is not necessary to perform asset-specific analyses, and it is possible to define projects that address multiple types of assets and investments that cut across predefined types. For example, a corridor project could include work on existing pavement and bridges, as well as intersection improvements that improve safety and mobility. However, an organization implementing a cross-asset prioritization approach must consider how to quantify its different goals and objectives, and explicitly weigh progress in one area versus another.

In practice, most agencies use an approach that involves both setting performance targets and prioritizing specific investments. The following subsections provide additional details on use of performance targets and multi-objective approaches, and provide examples illustrating emphasis on each of these areas.

- Chapters

-

Chapter 5

Sections - Chapter 5 Home Page

- Chapter PDF

Chapter 5

Quick Links

5.2.2

Use of Performance Targets to Support Cross-Asset Resource Allocation

A basic approach allocating resources across multiple types of assets is to define a set of performance targets by asset type. Development of TAM performance targets should be supported by data and the life cycle management approach described in Chapter 4. A resource allocation process that includes multiple types of investments, such as safety and mobility, may incorporate other targets, as well.

Target-setting is the process of setting specific values that an organization expects to achieve for a set of performance measures. Target-setting is important within the broader area of performance management, introduced in Chapter 2. Setting performance targets is consistent with best practice in asset and performance management. In its Transportation Performance Management (TPM) Toolbox, FHWA describes the benefits of setting performance targets:

- Driving a conversation about current conditions and how to achieve future outcomes

- Creating a method for evaluating processes currently in place, particularly data quality and measurement definitions used by the agency

- Guiding the prioritization and allocation of resources

- Enabling assessment of strategy effectiveness by focusing on linking goals, objectives, and measures to policy and investment decisions

- Forming a powerful argument for additional or alternative investments

- Managing expectations by clarifying what outcomes are desired

It is important to note that an organization may set targets at a strategic, tactical or operational level to support different applications:

- A strategic target is one which an organization expects to meet at some future time and reflects the agency’s overall goals and objectives. For instance, an agency’s long-term target for overall pavement condition is an example of a strategic target.

- A tactical target is a value an organization needs to meet to help support its strategic targets. For instance, to support a high-level target for pavement condition, an agency might set a tactical target to perform a specific amount of repaving work per year in each district.

- An operational target is one that helps track the day-to-day performance of an organization, such as the average time to respond to an incident. Operational targets are often used to support continuous improvement in standard operating procedures and process improvement tracking and monitoring.

The TPM regulations initiated by MAP-21 have specific requirements for state DOTs and MPOs to set performance targets for NHS pavement and bridge conditions, as well as for other areas outside of TAM, such as mobility and safety. In these regulations, a target is defined as the value for a performance measure the agency expects to achieve given available funding, rather than a desired or aspirational value. The benefits of target-setting are equally applicable regardless of whether an agency is setting targets specifically to comply with FHWA requirements or for other purposes.

There is as strong tie between target-setting and resource allocation. A target can both inform what investments an agency needs to make and help communicate the expected results of an investment strategy.

When an agency sets strategic targets to support allocating resources, the process is typically iterative. For instance, an agency might first determine the desired level of performance that best supports its goals and objectives, such as the overall performance that would result from maintaining all assets in good repair or the desired level of service for a set of assets. It would then be necessary to determine the level of investment (or allocation of other scarce resources) required to support this level of performance. At least one—and potentially many—iterations are required for an agency to determine a target performance that is not only consistent with its goals and objectives but also attainable given available resources. At each step, it can be helpful to use predicted performance given a certain allocation of resources to help communicate investment trade-offs and guide decision making.

Once an agency sets its strategic targets, it can then set tactical and operational targets. Developing and tracking such targets allows for better assessment of the actions to be performed at different levels of the organization to support strategic targets, and whether the agency is on track to meet its strategic targets – also termed “line-of-sight integration of decision making.”

Key points in setting performance targets to support TAM resource allocation include:

- Targets should be consistent with agency goals and objectives. Absent a specific constraint on resources, an organization should allocate resources as required to support its goals and objectives. For investments in existing assets, this should follow the life cycle plans developed as described in Chapter 4. If resources are constrained, it may be necessary to revise the life cycle strategy followed for one or more asset classes to focus investment on specific areas, although this may result in higher costs or worse performance in other areas over time.

- Use management systems to support target development. Pavement, bridge, and other asset management systems provide robust tools for summarizing current conditions and predicting future conditions and performance. In setting performance targets, it is important an agency use the analytical capabilities these systems offer in order to develop targets supported by data using a documented, repeatable process. Management systems are useful tools to help the decision-making process, but should support the process, not define it. Establish the allocation process the agency wants, and find tools that help implement it.

- An agency may have different targets for different subsets of a network. Particularly with strategic targets set at a network level, it will generally be the case for some subsets of the network or different geographic areas that performance will exceed the overall target, while others will lag behind the target.

- Factors not considered in management systems can impact performance. While management systems can help determine realistic targets, a decision maker should note the simplifying assumptions these systems make and thus remain aware of additional factors that may impact performance. For instance, management systems typically assume treatment on an asset can be performed in a single decision period, and the resulting impact on performance is immediately observed. In reality, projects often require multiple years to complete and there may be significant lag between when funds are committed and a resulting change in performance is observed. Factors outside the scope of management systems may also impact performance, such as diversions for emergency events or variability in condition assessment data and deterioration rates.

TIP

In many ways, resource allocation is the culmination of other TAM processes. These next pages describe how outputs from other processes should inform resource allocation for data-driven decision making.

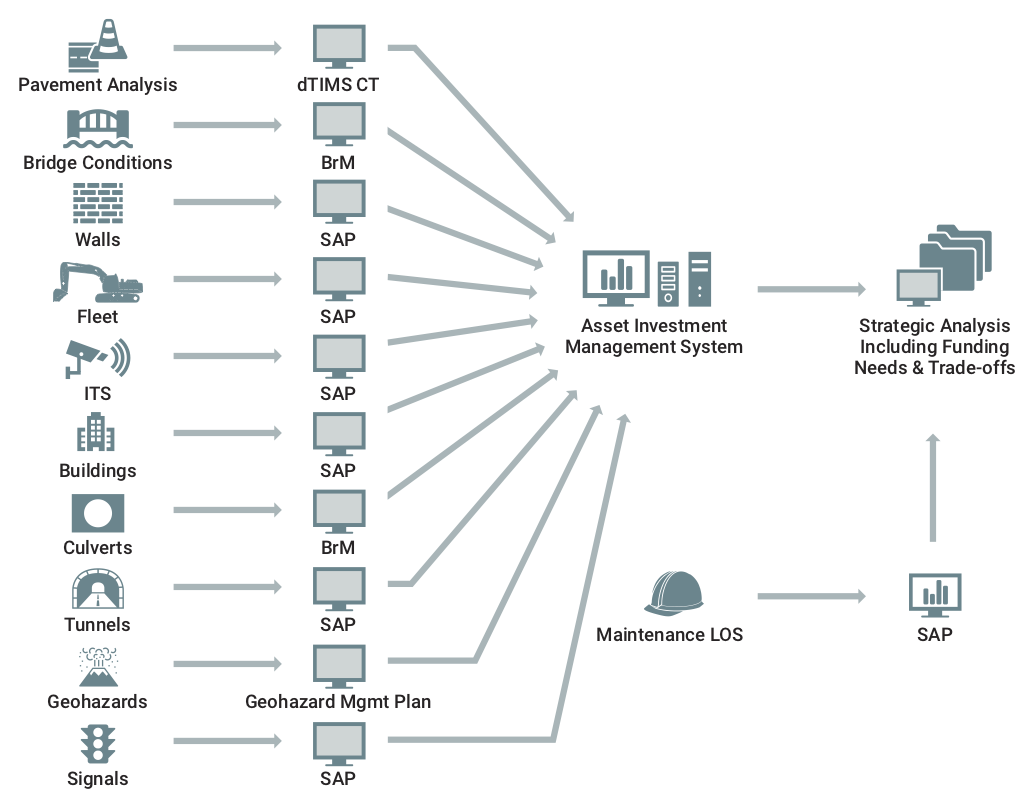

Colorado DOT

The budget-setting process used by CDOT and described in its 2018 TAMP is an example of a resource allocation process emphasizing use of performance targets to support cross-asset resource allocation. CDOT organizes its asset inventory into 11 different asset classes. Different management systems and approaches are used for each asset class to calculate current conditions and predict future performance given a specified budget and other data. The figure illustrates the asset classes and systems used to support analysis of each asset class as of 2018.

The measures used summarize conditions that vary by asset class. For instance, for pavement CDOT predicts percent of pavement with high, moderate, and low drivability life. For bridges, CDOT predicts percent of bridges in good/fair/poor condition based on the FHWA bridge condition measure. For maintenance and buildings CDOT predicts a level of service on a letter grade (A to F) scale.

On an annual basis CDOT performs a separate analysis for each asset class of existing conditions and predicted conditions for different budget scenarios. The manager for each asset class then presents a budget request and business case for the asset class in a workshop setting. Workshop participants, including the asset class managers and representatives from each CDOT region, then vote on the allocation of budget by asset class. The allocation serves as a recommendation to CDOT’s Transportation Commission, which is charged with adopting CDOT’s budget. Separate processes are used in each asset area to prioritize work once the budget is established.

Sources:

TAM Peer Exchange Presentation

CDOT Asset Classes and Analysis Systems

Source: William Johnson, 2018 FHWA TAM Peer Exchange

- Chapters

-

Chapter 5

Sections - Chapter 5 Home Page

- Chapter PDF

Chapter 5

Quick Links

5.2.3

Use of Multi-Objective Decision Analysis for Resource Allocation

Multi-Objective Decision Analysis (MODA) can be used to prioritize specific candidate investments considering multiple, potentially competing objectives. Though this approach is data-intensive, it provides the means for evaluating investments that combine multiple types of assets or investments that help achieve multiple objectives.

TAM Guide Book Club #7: Investment Strategies and Multi-Objective Decision Making

In recent years, interest has increased in using MODA to improve approaches for prioritizing investments across asset classes and investment categories. The basic benefit of this approach is that it provides a structure for prioritizing investments outside the scope of any one management system, such as projects combining pavement, bridge and safety improvements. It also provides a means to compare asset management investments with other investments to improve mobility and achieve other objectives outside the scope of a typical asset management system.

This approach is, however, more data intensive and may result in simplification of the asset-specific modeling performed in a pavement or bridge management system. MODA tools and approaches are typically intended for application in analyzing specific candidate projects, and used for prioritizing investments for a single decision period. However, it is possible to adapt a MODA approach for cases where data are sparse or where groups of investments are analyzed rather than specific investments, or where longer decision periods are considered.

NCHRP Report 806: Guide to Cross Asset Resource Allocation and the Impact on Transportation System Performance presents a framework and prototype tool for implementing a MODA-based approach. Additional research through NCHRP Project 08-103 extended the framework and updated the tool. A checklist based on this work is included in this section; it outlines key issues for an agency considering improvements to its resource allocation approach to better account for multiple objectives across asset classes or investment categories.

North Carolina DOT

Since 2009, North Carolina DOT has used a structured approach to help prioritize capital investments across modes and asset classes. The initial version of the approach (Version 1.0) focused on prioritizing mobility and highway modernization projects supported by data on congestion, crashes and pavement condition. Over time the process evolved to include additional investment types and data. North Carolina’s Strategic Transportation Investments Law adopted in 2013 helped formalize the process, requiring that NCDOT allocate 40% of its available funds for mobility to Statewide Mobility projects that address congestion and bottlenecks, 30% of funds to projects with Regional Impact that improve connectivity within Regions, and 30% of funds to projects that address local needs. Different approaches are used for prioritizing investments in each mode (highways, aviation, bicycle-pedestrian, public transportation, ferry and rail) within each of these three groups. In Version 5.0 of the process, implemented in 2018, 24 different types of improvements are considered for highways. Candidate projects are scored in 10 areas, including pavement condition, considering a mix of existing conditions and predicted conditions as a result of the proposed project, as illustrated in the figure.

Highway Scoring - Eligible Criteria with P5.0 Measures

| Criteria | Measure | Existing Conditions | Project Benefits (Future Conditions) |

| Congestion | Volume/Capacity + Volume | ||

| Benefit/Cost | (Travel Time Savings + Safety Benefits)/Cost to NCDOT | ||

| Safety/Score | Critical Crash Rate, Density, Severity, Safety Benefits | ||

| Economic Competitiveness | % Change in Jobs + % Change in County Economy | ||

| Accessibility/Connectivity | County Economic Indicator, Improve Mobility | ||

| Freight | Truck Volume, Truck %, Future Interstate Completion | ||

| Multimodal | Multimodal Benefits | ||

| Lane Width | Existing Width vs. Standard Width | ||

| Shoulder Width | Existing Width vs. Standard Width | ||

| Pavement Score | Pavement Condition Rating |

Source: NCDOT. 2019. https://connect.ncdot.gov/projects/planning/MPORPODocuments/P5.0%20Master%20Presentation%20-%20July%202018.pdf

Caltrans

The approach for allocating funding within the Caltrans State Highway Operation and Protection Program (SHOPP) is an example of a “bottom-up” multi-objective, cross-asset resource allocation approach. The SHOPP funds repair, preservation, and safety improvements on the California State Highway System (SHS). The SHS is comprised of approximately 50,000 lane miles and the 2018 SHOPP will implement $17.96 billion in projects over four years. The SHOPP programming cycle results in a four-year program of capital projects that achieve the performance targets specified in the TAMP, consider the fiscal constraints, and address the needs identified in the State Highway System Management Plan.

In an effort to make the process more data-driven, Caltrans piloted a MODA approach to prioritize projects for inclusion in the SHOPP. The agency used the goal areas identified in their Strategic Plan (Safety and Health; Stewardship and Efficiency; Sustainability, Livability, and Economy; System Performance; and Organizational Excellence) and established criteria to evaluate projects across the five goals. In the initial pilot, Caltrans focused on obtaining the technical data necessary to evaluate how well each project progressed towards its goals. The agency is in the process of refining the approach based on the results of the pilot. They revised the goal areas to best account for all the activities included in the project. In addition, they represent each project score through a monetized benefit value, which addresses challenges related to scaling and weighting. With the revised approach, projects are scored based on the annual benefit of performing the project relative to deferring work for one decision period (two years). Benefits predicted using the approach are analogous to monetized benefits predicted using benefit/cost analysis tools and approaches, such as the Cal-B/C tool Caltrans uses to evaluate potential highway improvements. This approach leverages prior work performed to quantify the benefits of a proposed investment, and helps address issues with scaling and weighting different measures of benefit encountered in the initial pilot.

Sources:

TAM Peer Exchange Presentation

2018 SHOPP https://www.trb.org/Publications/Blurbs/180176.aspx

NCHRP 08-103, Preliminary Draft Final Report

Financial Planning

A TAM financial plan describes the sources of an organization’s funds and how funds will be used over time on TAM activities. Resource allocation and TAM financial planning are closely linked activities. TAM financial planning both contributes to the resource allocation process and uses its results.

- Chapters

-

Chapter 5

Sections - Chapter 5 Home Page

- Chapter PDF

Chapter 5

Quick Links

5.3.1

TAM Financial Plan

A financial plan describes the sources of an organization’s funds and how funds will be used over time. Fundamentally, an organization prepares financial plans because it is good business practice and because doing so is required to comply with various state and federal requirements and accounting standards.

TAM Guide Book Club #4: Improving TAM Financial Planning

MPOs are required to prepare financial plans as part of LRTP and TIP development. DOTs also have to prepare financial plans for their NHS TAMPs. The federal requirements help guide practice in many agencies. However, there are often additional state-level requirements for financial planning and reporting that may impact the preparation of financial plans.

The financial plan prepared for an MPO LRTP requires system-level estimation of costs and revenue sources with reasonably expected availability to adequately operate and maintain the federal-aid highways included in the plan. LRTPs have a planning horizon of 20 years or more, but beyond the first 10 years of the plan the costs may be specified using aggregate cost ranges. MPOs, transit operators and states are required to work together to develop the financial plan. Requirements for LRTP financial plans are listed in 23 CFR 450.324 (f)(11).

The financial plan for a MPO TIP serves a similar purpose as for an LRTP: to show that funding is reasonably expected to be available for projects within the plan. Funds must be estimated by year for over a period of at least four years. A TIP financial plan does not need to include funding for other activities outside of the projects included, but should include some form of system-level estimation of costs of operating and maintaining federal-aid highways, as well as confirmation that sufficient funds are available for implementing, operating and maintaining the system. As in the case of LRTP financial plans, MPOs, transit operators and states are required to work together to develop the plan. Requirements for TIP financial plans are listed in 23 CFR 450.326 (j).

For SLRTP and STIPs, the elements of a financial plan are similar to those for LRTPs and TIPs, respectively. However, the financial plan for these documents is an optional element. SLRTP requirements are described in 23 CFR 450.216 and STIP requirements are described in 23 CFR 450.218.

Separate requirements specify the contents of a financial plan prepared for a State’s NHS TAMP. 23 CFR 515 specifies that a TAMP financial plan is a “long-term plan spanning 10 years or longer, presenting a State DOT’s estimates of projected available financial resources and predicted expenditures in major asset categories...”

TAM Webinar #28 - Financial Plans and Investment Strategies

Regulations further stipulate that the process for preparing a financial plan must include:

- Estimating the cost of expected future work to implement the investment strategies in the TAMP by fiscal year and work type

- Estimating funding levels that are expected to be reasonably available by fiscal year

- Identifying anticipated funding sources

- Estimating the value of the agency’s NHS pavement and bridge assets

- Estimating the needed investment on an annual basis to maintain asset value

TIP

Risk can be incorporated into resource allocation informally (as general considerations) or more formally (e.g. through the life cycle management process or as a criteria in a multi-objective decision making process).

TAM Webinar #48 - Improving Your Next TAMP Miniseries: Improving Your Financial Plan

In addition to preparing financial plans in the documents described above, state DOTs and other organizations typically prepare annual financial statements. The U.S. Governmental Accounting Standards Board (GASB) establishes standards for state and local governments to use in following Generally Accepted Accounting Principles (GAAP). These standards describe how governments should perform their accounting and prepare financial statements. A financial statement prepared based on GAAP describes an organization’s financial position for a given reporting period, such as a fiscal year, and typically does not include detailed projections of future funding and work. A financial statement prepared to comply with GASB standards and a financial plan prepared to support an LRTP, TIP or TAMP are meant to serve different purposes, but the same underlying concepts inform the development of all these products.

Financial statements and Federally-compliant NHS TAMPs both include calculations of asset value. Reporting asset value in a TAM financial plan helps communicate what assets an organization manages in a common unit applicable to all assets: dollars. Estimates of asset value in a TAM financial plan are typically based on asset replacement cost. The value of an asset may be depreciated on remaining asset life or current asset condition. Where a depreciated asset value is calculated the cost to maintain asset value is equal to annual depreciation. This can provide a useful benchmark for the minimum spending required to maintain an inventory of assets.

The asset value reported in a financial statement is prepared in compliance with GASB requirements, and is often prepared differently than that in a TAMP. For financial statements agencies typically apply straight-line deprecation to historic capital costs to estimate the current book value of their assets. The historic cost of constructing an asset is different from the cost to replace an asset in today’s dollars, and the annual depreciation calculated using this approach is different from the cost of actually maintaining asset condition. GASB requirements allow for addressing this issue using a “modified approach” for calculating asset value. This alternative approach involves calculating a cost to maintain assets using an organization’s management systems in lieu of calculating straight-line depreciation. Where this approach is used it provides a calculation of asset value that can be used in both a TAM financial plan and an organization’s GASB-compliant financial statement.

- Chapters

-

Chapter 5

Sections - Chapter 5 Home Page

- Chapter PDF

Chapter 5

Quick Links

5.3.2

Implications for Resource Allocation

In determining how to allocate financial resources, a decision-maker needs information on available funds. The output of the resource allocation process is an allocation of funds or other resources needed for the financial plan. Thus, financial planning both informs the resource allocation process and uses its results.

Development of a financial plan is separate from, but closely related to, the resource allocation process. Thus, there must be a high level of coordination between financial planning and resource allocation, particularly with respect to TIP and TAMP financial plans.

Although different financial plans are required for different applications, for practical purposes an organization should use consistent assumptions in developing its financial and strategic plans to the fullest extent possible, including the plans described above and other related documents.

Areas where integrated approaches and assumptions between different planning documents are most beneficial are:

- Revenue projections. Ideally, a single office or group should take responsibility for projecting future revenues incorporating the organizations best estimates of revenue sources, demographic trends and other factors.

- Inflation assumptions. To predict how much it will cost to perform work in current dollars it is necessary to apply an appropriate inflation assumption. Predicting future inflation is challenging and results of the resource allocation process may be highly sensitive to the assumed inflation rate. Thus, it is important for an organization to make a consistent set of assumptions concerning inflation in its different financial plans. Often, the same unit responsible for revenue projections also predicts future inflation.

- Operating and maintenance costs (O&M). Costs of operating and maintaining existing assets may be components of the different federally-required plans, but they typically are not a focal point of the planned use of capital funds. From an asset management perspective, it is important to accurately predict these costs and include them as part of any financial plan.

While integrating approaches is highly desirable, the varying scopes and requirements for different financial plans and statements may lead to different results even when approaches are integrated. Financial planners should still carefully document and communicate any areas where different financial plans and statements appear to diverge.

Such instances can result from:

- Timing of plan preparation. A transportation agency’s financial situation may change from year-to-year or even day-to-day. A financial plan captures an agency’s best estimates at a given point in time, and it is not uncommon that the financial assumptions made for a given plan will be different when revisited for another plan at a later time.

- Different planning horizons. Long-range plans, TIPS and TAMPs all have different planning horizons. The length of the planning horizon can impact how numbers are presented in a plan and how they are communicated. For instance, the aver- age annual O&M cost for the Federal-aid system, stated in current dollars, will be different over a 20-year period than over a 10- or 4- year period due to the effects of inflation and changing system conditions.

- Different contexts. Although using consistent assumptions and approaches between different financial plans and statements is desirable, in some cases the varying contexts and requirements demand the use of different approaches. An example of this issue is in asset valuation described in the previous section.

TIP

Although closely linked, financial planning should not be confused with resource allocation.

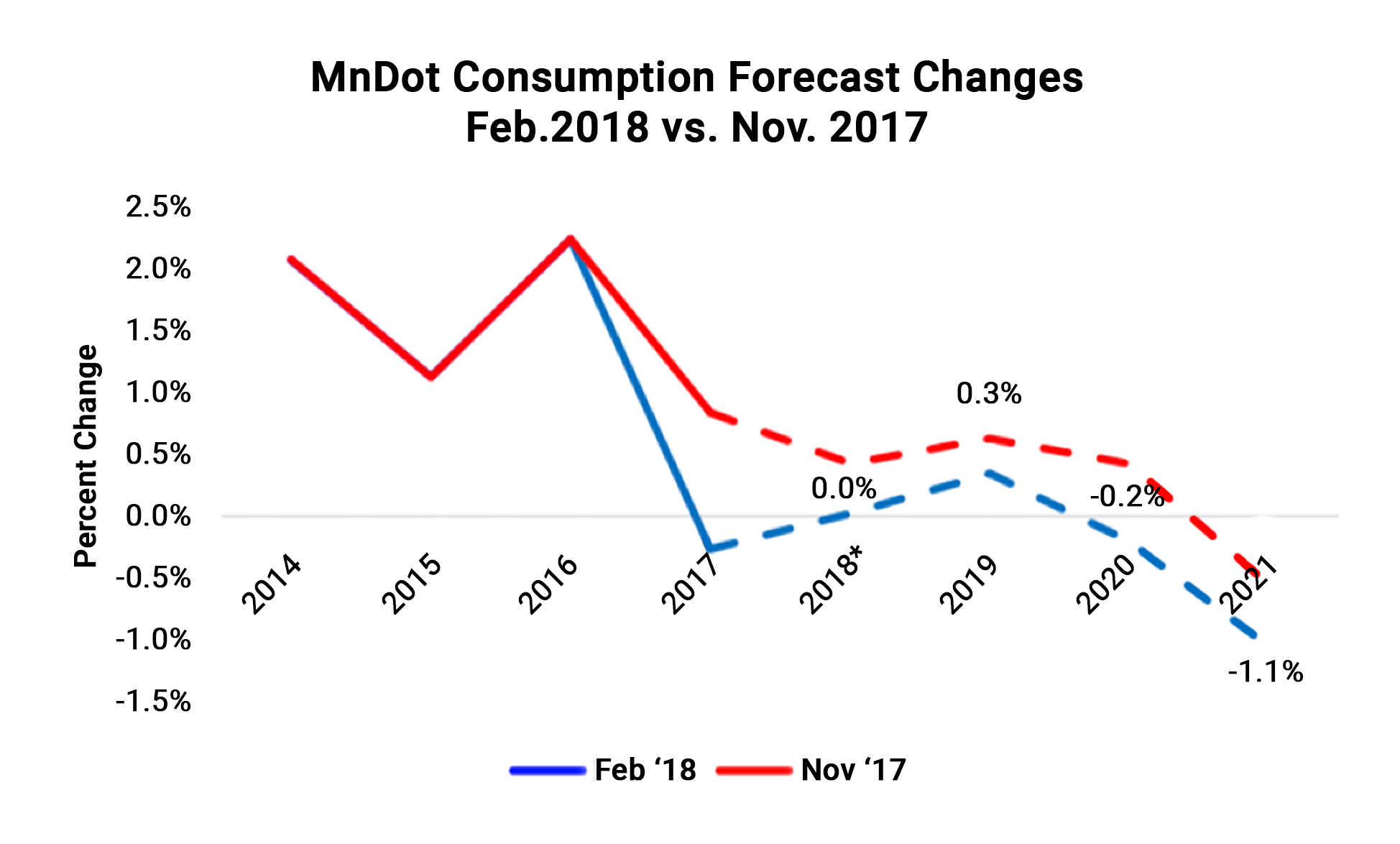

Minnesota DOT

MnDOT forecasts future funding in its annual Transportation Funds Forecast. This document projects funding by source for a four-year period. The report includes the funding projection, as well as additional details supporting the projections. For instance, it details trends in key parameters that impact funding, such as fuel consumption and vehicle sales. For these and other parameters the report shows historic trends, prior projections, and revised projection. The graph below, reproduced from the 2018 report, shows data for historic and predicted fuel consumption. The report also documents reasons for any changes in the projections, and risks that may impact future revenue. MnDOT uses its revenue projections to support development of the STIP, as well as to inform the funding projections in other reports, such as the TAMP and LRTP.

Source: MnDOT Transportation Fund Forecast. 2018. https://www.dot.state.mn.us/funding/documents/Transportation%20Forecast%20Feb%202018.pdf

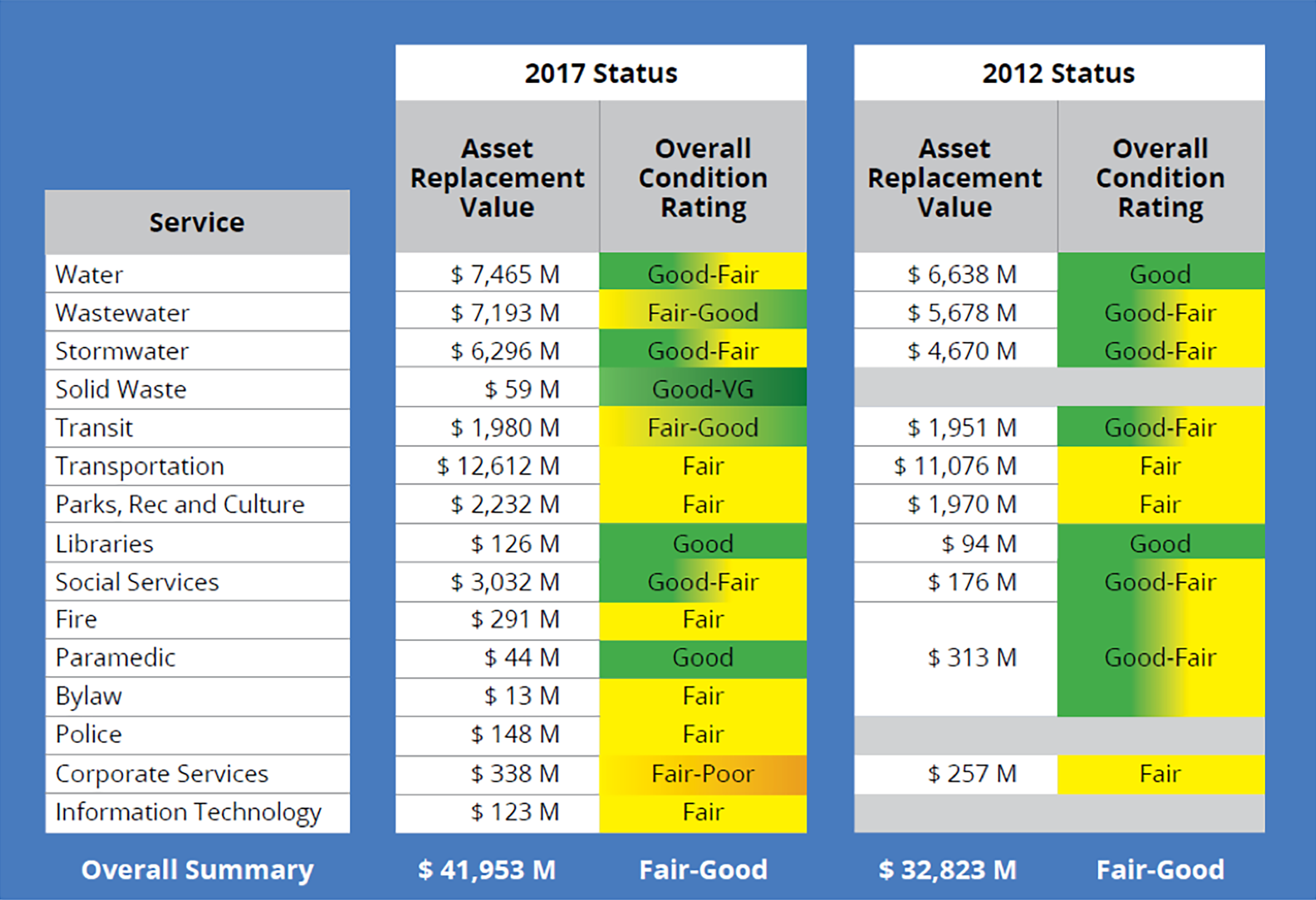

City of Ottawa

The Province of Ontario was one of the first jurisdictions in Canada to pass legislation that required all municipalities within the province to prepare an asset management plan for all core municipal infrastructure. Municipalities have since been undertaking similar planning methods to all municipal infrastructure. Initial regulations required plans to have specific components including the Current State of the Infrastructure (a summary of replacement value, current condition, rate of depreciation and resulting residual value of the portfolio) as well as other components (Levels of Service, Asset Management Strategy, Financing Strategy and Improvement Plan). The State of Infrastructure reporting is a useful method to provide a snapshot of the current status of infrastructure and its ability to continue to deliver services. The City of Ottawa has been a leader in developing a comprehensive asset management program and making infrastructure investment based on a systematic approach. For example, State of the Infrastructure reporting is conducted for all asset types, and summarized in annual council reporting.

Work Planning and Delivery

Investments are conceived and delivered in many different ways. The different models used for work planning and delivery have an impact on the resource allocation approach.

- Chapters

-

Chapter 5

Sections - Chapter 5 Home Page

- Chapter PDF

Chapter 5

Quick Links

5.4.1

TAM Work Planning and Delivery

The approach used to deliver work can have a major impact on what investments an organization makes, the resources required to perform work, and work timing. Transportation agencies have many options for performing work, including using internal forces to perform work, and/or using a variety of different contracting approaches.

Typically, U.S. transportation agencies perform some or most of their maintenance work internally, and contract out a large portion – if not all – of their capital projects. The line between the types work performed as maintenance and capital projects varies by organization and is often blurred. Agencies can often use maintenance forces in a flexible manner to perform a wide variety of activities, including preservation activities on pavements, bridges and other assets. However, in the near term, an organization’s maintenance resources – staff and equipment, in particular – are fixed. Consequently, the asset owner is challenged to optimize use of these resources to meet immediate needs, such as winter maintenance and incident response, while performing additional work to improve asset conditions wherever possible.

The ability to contract out maintenance work, such as through Indefinite Delivery/Indefinite Quantity (IDIQ) contracts, provides an agency with flexibility in meeting near-term needs. Other approaches for contracting out maintenance work include use of portfolio or program management contracts in which certain operations and maintenance responsibilities for some group of assets is delegated to a contractor over a specified period of time. Section 4.3.3 provides additional details on considerations involved in outsourcing asset maintenance.

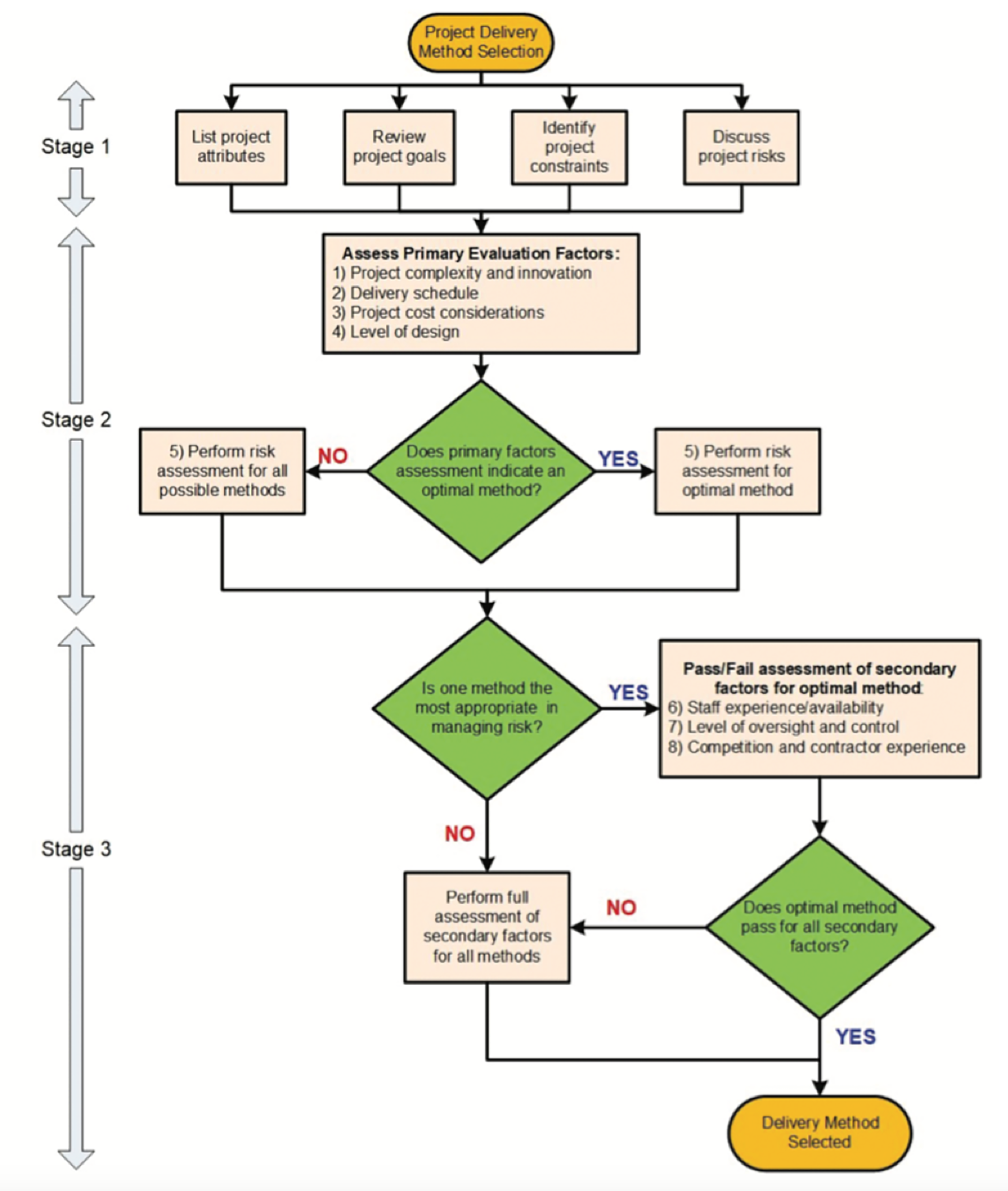

Regarding contracting approaches for capital projects, in the U.S., most transportation agencies rely on Design-Bid-Build (DBB) model for delivering their capital programs. With this approach, the project owner designs a project (or contracts for a private sector firm to prepare a design) and solicits bids for project construction following completion of the design. This provides the project owner with control over the process, but can be time consuming and can result in cases where bids for project construction exceed the expected cost developed during design. In recent years, many transportation agencies in the U.S. and abroad have explored improved approaches to work planning and delivery to accelerate completion of needed work, leverage alternative financing approaches and transfer program and project risk.

All of these approaches are intended to reduce the time from initial conception of a project to its completion, and in many cases transfer risks associated with project completion from the public sector to the private sector. As these examples help illustrate, major trends in this area include:

- Group work together by geographic location or type of work to develop fewer, larger, and more easily contracted projects

- Use Design-Build (DB), Design-Build-Finance-Operate-Maintain (DBFOM) and other contracting strategies, wherein a single contract is awarded to design and complete a project, as opposed to separate contracts for design and construction

- Encourage development of Alternative Technical Concepts (ATCs), wherein a contractor proposes an alternative approach to meeting a contract requirement in the bidding phase

- Select contractors earlier in program/project development through use of Construction Manager-General Contractor (CM-GC) arrangements, where a contractor is selected as Construction Manager while design is still underway

- Use IDIQ contracts and other flexible contracts to provide a more efficient mechanism for performing smaller projects

- Incorporate performance-based specifications, time-based incentives and other specifications in contracts to improve project outcomes

- Outsource operations and maintenance of an asset using program or portfolio management contracts.

Both in the U.S. and abroad there are many examples of public agencies making extensive use of alternative contracting strategies, such as Public-Private Partnerships (P3s) and performance-based contracts to speed project delivery and transfer risk.

While alternate strategies for work planning and delivery hold great promise, all of the approaches described here have advantages and disadvantages and carry their own risks. Use of alternative approaches can save taxpayers money and provide improvements more quickly than a traditional model. Success stories typically result from improving the efficiency of the process and incentivizing the use of better technology and methods, but there are also many cautionary examples in which these strategies have failed to achieve cost savings, time savings or risk transfers as desired. Asset owners should consult the separate body of research in this area (referenced at the end of this section) when exploring the use of alternative approaches and carefully weigh the expected return, advantages and disadvantages of whatever delivery approaches they consider.

- Chapters

-

Chapter 5

Sections - Chapter 5 Home Page

- Chapter PDF

Chapter 5

Quick Links

5.4.2

Implications for Resource Allocation

The different work delivery approaches that are available should be considered both at the outset of the resource allocation process, and as part of finalizing the resource allocation plan. Frequently it is necessary to consider multiple allocation scenarios using different delivery approaches.

The availability of alternative approaches for work delivery creates opportunities for organizations to improve asset conditions and address other needs in a more efficient manner, thereby performing needed work sooner, at a lower overall cost and/or with less risk to the organization. It is important to consider different work delivery strategies both early in the resource allocation process (as part of Step 2 – Determine Constraints) and at the end of the process (in Step 7 – Finalize Allocation and Plans).

Considering alternative delivery approaches early on as investment needs are identified helps identify options and determine approaches that an organization can use to achieve the best results. For instance, in determining how to allocate resources for asset maintenance an organization may wish to explore the potential for outsourcing additional maintenance work if there are specific constraints on staff or materials that could be relaxed using an alternative delivery approach. To properly assess the alternatives it may be necessary to define multiple scenarios, such as a scenario in which a “business as usual” approach is used for delivery, and a second scenario in which increased flexibility is assumed regarding use of different delivery methods.

Once an initial allocation of resources has been made, it is important to review options for delivery to revisit prior assumptions and identify opportunity to lower costs and improve outcomes. For instance, once overall budget levels have been established by asset and/or work type in a financial plan, an organization may need to revisit delivery options when scoping specific maintenance activities or capital projects.

The practice examples describe improved delivery approaches used in the U.S. and abroad, and discuss their impacts on resource allocation.

The Work Planning and Delivery checklist lists factors to consider during the resource allocation process for maintenance and capital projects to leverage opportunities for improved work planning and delivery.

Colorado DOT