- Chapters

-

Chapter 5

Sections - Chapter 5 Home Page

- Chapter PDF

Chapter 5

Quick Links

5.1.4

Consideration of Risk in Resource Allocation

Uncertainty and risk complicate the resource allocation decision-making process. Risk management activities, including developing a risk register, are helpful in understanding and mitigating uncertainty, which in turn has implications for resource allocation.

Overview

All transportation decision-makers must contend with uncertainty. In regards to resource allocation, uncertainty is inherent in variables such as data on asset conditions and performance, future funding levels and costs, how a transportation system and specific assets will perform, and what external events or other factors may require reallocating resources. This uncertainty complicates efforts to make decisions about the future and forces agencies to be nimble so as to effectively respond to unpredictable events and evolving conditions.

In recent years, transportation and other industries have made significant progress developing improved approaches for managing uncertainty to minimize negative and leverage positive impacts. An area of focus in transportation has been in managing the risk of project cost and schedule overruns; a number of agencies have established enterprise risk management programs in order to address risk and uncertainty across their organizations. Likewise in TAM, there is increased interest in identifying and assessing risk so as to comply with both the best practices and the FHWA requirement for state DOTs to consider risk in developing their NHS TAMP.

The word ‘risk’ can be very context specific, meaning very different things depending on the industry and application. For instance, a financial analyst is primarily concerned with uncertainty in financial returns and the risk of incurring a significant financial loss. In the nuclear power industry, however, the focus of managing risk is on minimizing the potential for catastrophic loss that might occur from damage to a nuclear facility. As discussed in Chapter 2, in this guide risk is defined as the “effect of uncertainty on objectives” consistent with the ISO definition. This definition captures the full range of applications of risk management, and acknowledges the possibility for both positive and negative consequences of uncertainty.

The term ‘risk management’ is used to capture the set of business processes associated with identifying and managing uncertainty and risk. The overall risk management process is described in Chapter 2. The remainder of this section describes how this process relates to resource allocation.

Implications for Resource Allocation

While the scope of risk management may be very broad, an organization’s approach to risk management and the outcomes resulting from a risk assessment may nonetheless have important implications for TAM resource allocation. Consequently, it is important to establish a risk management approach and integrate consideration of risk with the resource allocation process.

TIP

Multi-objective decision making is a concept in operations research that is implemented in several different forms, from simple consensus-building approaches (e.g. Delphi processes) to more complex software tools. In all cases, it allows consideration of more than one factor or criteria in making a decision.

Specific possible implications of risk management on resource allocation may include, but are not limited to:

- An organization may identify through its risk management approach areas where better data or improved processes are needed to best address a given risk, in turn impacting the resource allocation process. For instance, if uncertainty concerning future asset conditions is found to be a significant risk, this may result in efforts to improve the deterioration models in an agency’s asset management systems and/or motivate data collection improvements to reduce uncertainty.

- An organization may identify specific investments of staff time and/or agency funds required to mitigate negative or leverage positive risk. Once specific investments are identified, they can be assessed along with investments in other asset/investment categories. For example, Caltrans defined a separate program for seismic retrofits as described in the Practice Example.

- If an agency’s allocation of resources hinges on uncertain future values for one or more parameters, it may be necessary to incorporate consideration of uncertainty formally in the decision-making process. This can be accomplished using Monte Carlo simulation or other quantitative approaches to establish the predicted distribution of outcomes. For instance, in performing a life cycle cost analysis to select between project alternatives for a given facility, Monte Carlo simulation can calculate the range of life cycle costs predicted depending on future values for cost escalation, deterioration, or other parameters.

- In approaching formal accounting for uncertainty, an organization may define different scenarios representing the possible range of outcomes and then determine how best to allocate resources in each scenario before establishing a preferred resource allocation approach. For example, if an agency’s future capital budget is unknown, a decision-maker may wish to define a high, medium and low budget scenario and determine what investments would be made in each scenario in order to most effectively prioritize given uncertainty. Likewise, a scenario analysis approach can be useful in assessing how to allocate resources for improving infrastructure resilience given uncertainty concerning future sea level rise. Typically, the decision maker will review results for different scenarios and make a subjective determination of how to allocate resources considering the relevant factors. The Practice Example describing the analysis of harbor-wide barrier systems for the City of Boston shows one such approach. Recent research in the area of Robust Decision Making (RDM) has focused on developing quantitative approaches to select optimal investments between different scenarios.

Caltrans

Caltrans initiated its Seismic Safety Retrofit Program in the wake of bridge failures experienced in the 1989 Loma Prieta Earthquake. Through this program Caltrans evaluated the retrofit needs for all of the over 12,400 bridges on the State Highway System (SHS). Retrofit needs were prioritized using a multi-attribute procedure that calculated a score for each bridge considering the likelihood of an earthquake at the bridge site, the vulnerability of the bridge to collapse in the event of an earthquake, and the impact of a collapse considering the traffic using the bridge and detour distance in the event of a collapse. Through 2014 the program resulted in retrofit of 2,202 state highway bridges at a cost of over $12.2 billion.

Sources:

2018 Caltrans TAMP

Practical Lessons from the Loma Prieta Earthquake (1994), p. 174-180 https://www.nap.edu/catalog/2269/ practical-lessons-from-the-loma-prieta-earthquake

University of Massachusetts

The Sustainable Solutions Lab at the University of Massachusetts Boston used a scenario-based approach to analyze the feasibility and potential risk reduction of Boston Harbor barrier systems to protect the Boston area from future flooding due to sea level rise. The report included an economic analysis in which costs and benefits were predicted for 32 scenarios considering:

- Two barrier system alternatives

- Two construction time scenarios

- Two scenarios for effectiveness of “shore-based solutions”

- Low and high construction cost estimates

- Discount rates of 3% and 7%

The analysis indicated that the benefits of the proposed barrier system would exceed their cost for both systems evaluated, but only in the case that one assumed a low discount rate, accelerated construction schedule, and failure of other shore-based solutions for mitigating sea level rise. Also, the analysis indicated that beyond a certain point sea level rise would be such that a barrier system would no longer prove effective (since the barrier would have to be closed at all times rather than only during flood events). The report further predicted costs and benefits for two alternative scenarios involving incremental adoption of a variety of shore-based mitigation approaches, and recommended an initial focus on shore-based adaption as the most promising strategy for the City of Boston to address sea level rise.

Regional Municipality of Peel (Canada)

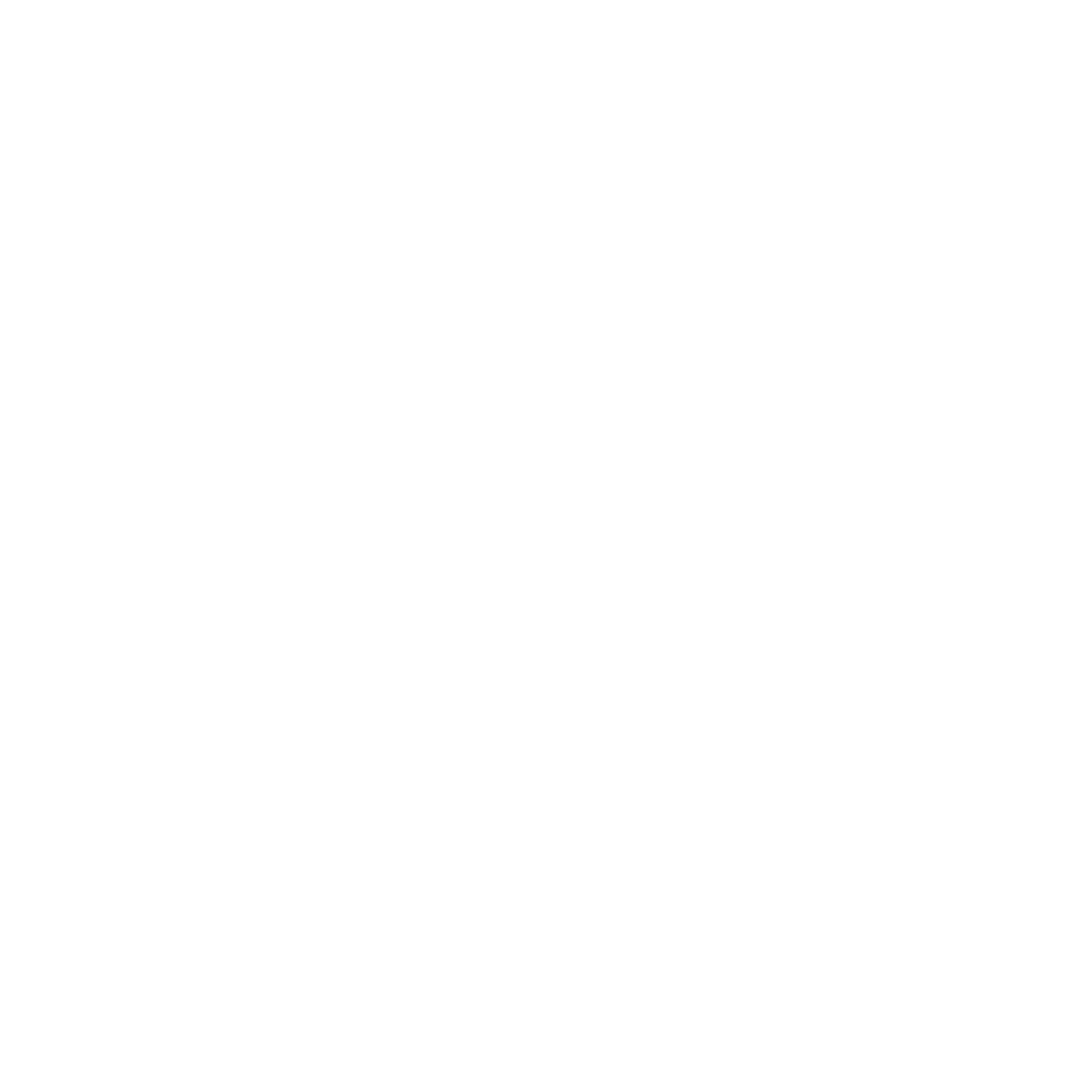

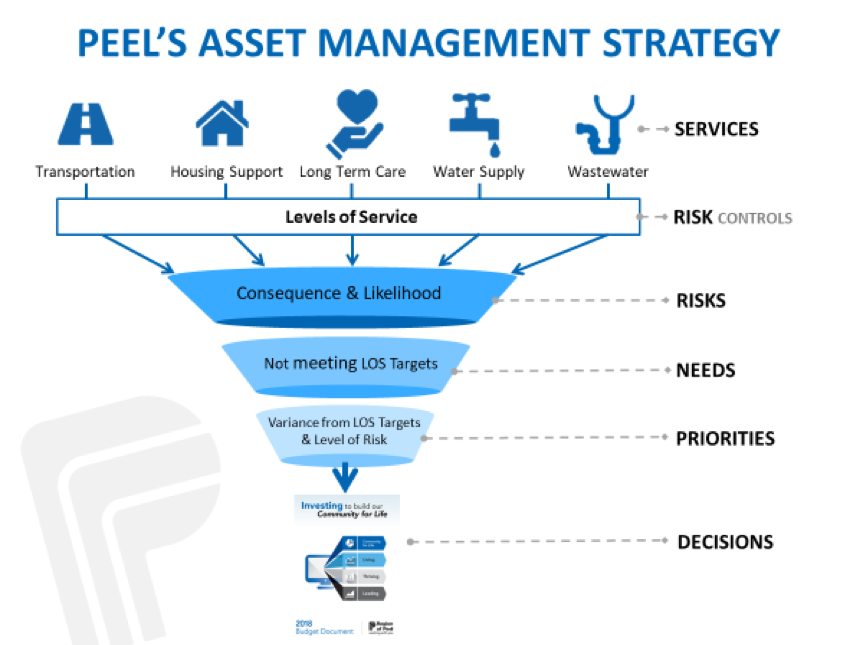

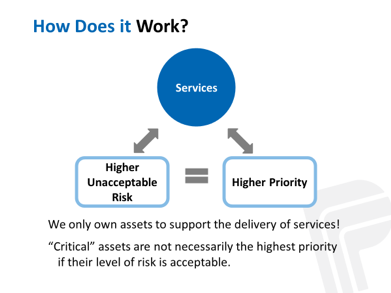

The Region of Peel is the second largest municipality in Ontario, just west of Toronto and supports two cities and a town. Peel assesses needs and priorities across a diverse portfolio of Infrastructure that supports a variety of programs and services including an arterial roads network, solid waste management, water and wastewater treatment distribution and a variety of social, health and emergency services. The Region integrated a number of inputs to enable an optimized investment methodology including a Risk Management, Level of Service, and Life cycle Management Strategies and priortize needs across diverse infrastructure, as illustrated in the figure. The integration of these three strategies was possible through three enablers and working with all of the programs and services to model their infrastructure:

- Establishing a consistent approach to quantifying risk – The Region evaluates the degree of risk that is currently being accepted associated with delivering service levels. Inherent risk (similar to asset criticality) and residual risk (the Region’s risk objective) are established and the current level of risk that an asset presents to service delivery is also determined. The gap between current and residual risk represents the unmet funding and asset needs.

- Establishing a normalized method to determine current level of service to assist the cross-asset funding allocation task. The adopted normalized indicator was determined to be: LOS=% of Assets Meeting LOS + (% of Assets Not meeting LOS x Average Condition of Assets not meeting).

- Adopting a direct relationship between LOS and risk that allows for an analysis of alternative investment scenarios, and modeling techniques to optimize investment allocation. It also allows annual infrastructure evaluation based on the most current condition information and annual Asset Management Reporting.

Peel’s risk-based approach to asset management is integrated with the Region’s Strategic Plan and the Long-Term Financial Planning Strategy, and supports the desired service outcomes by evaluating risk against the Council approved asset levels of service. This approach provides senior decision-makers an objective way to consider resource allocation alternatives and communicate in a common language when evaluating between service areas and different asset portfolios.

Peel Enterprise Asset Management Plan. 2019. http://www.peelregion.ca/council/agendas/2016/2016-04-07-arc-agenda.pdf. http://www.peelregion.ca/finance/_media/2019-enterprise-asset-management-plan.pdf