- Chapters

-

Chapter 5

Sections - Chapter 5 Home Page

- Chapter PDF

Chapter 5

Quick Links

5.5.2

Using Asset Value to Support TAM Decisions

Once calculated, asset value and related measures can support a range of applications in transportation asset management. These applications are summarized through a set of six key questions which asset value and related measures may help answer.

Note: This subsection was derived from the web version of A Guide to Computation and Use of System Level Valuation of Transportation Assets. More detailed information is available in this NCHRP Report. A summary is provided below to provide an overview and context.

6 Key Summarizing Questions

- What is the overall value of the asset inventory? This is the most fundamental question about asset value. What exactly is the value of a given inventory of assets?

- What is the cost to maintain current asset value? Establishing overall asset value for each asset classification is a prelude to this follow up question. An agency would need to determine how much value is lost each year as assets age, and what investments are needed to offset depreciation and optimize the assets’ lifespans.

- How much should an agency invest in existing assets? This question is closely related to the second question, but the two questions may have different answers. If the measure of value is meaningful, then an agency should ideally spend enough money to maintain or increase asset value over time. However, it is inevitable that the value of a given asset will decline following construction or renewal of the asset: it is simply not realistic to expect assets to remain in a “like new” condition indefinitely. On the other hand, if the value of the asset inventory has declined to the point that is demonstrably suboptimal (e.g., a case in which assets are in such poor condition that users experience increased costs from delay and the agency incurs increased costs from emergency maintenance) then merely maintaining existing condition is undesirable. Answering this question requires additional analysis to determine the asset value associated with achieving an agency’s “desired state of good repair,” and the cost to achieve this value. Once obtained, the answer supports decisions about how much to invest in the asset inventory.

- How should funds be allocated between different assets or networks? To the extent that funds are insufficient for addressing all of an agency’s investment needs, it may be necessary to prioritize between different asset classes or networks (e.g., the Interstate System, Non-Interstate NHS, and Non-NHS). Information on asset value helps communicate the size of the inventory expressed in a single unit of measure – dollars.

- What’s the best life cycle strategy for our assets? Information on asset value, together with supporting management systems, can be used to test different asset life cycle strategies and illustrate the effectiveness of different strategies for maximizing value. Doing this requires predicting asset value assuming different strategies and comparing their results.

- What is the value generated by the asset? Much of the discussion thus far has revolved around the value of the asset, as it relates to construction and maintenance costs. However, two assets of the same type, length, and roadway characteristics may generate strikingly different value for the communities that use them. Variations in the volume of traffic, the availability of alternative routes, and the accessibility offered by these roads are only some of the factors affecting how road users perceive their value. When considering investment decisions, it is important to account for the road user’s perspective.

Department of Transport and Planning

The City of Melbourne, the capital of the Australian state of Victoria, uses asset value to drive asset management in two ways:

First, the city communicates the asset inventory in part through asset value. The City Asset Plan includes both the fair, written-down value (current depreciated value) and a replacement value for each of the assets owned by the agency, including numerous infrastructure assets such as roads, bridges, footpaths, drainage, and other assets. The city uses these two numbers to communicate the extent and condition of their assets to the public and other stakeholders.

Second, the city uses two performance measures related to asset value to demonstrate fiscal responsibility: the ratio of renewal and upgrade expenditures to depreciation, and the ratio of total capital replacement expenditures to depreciation. These measures are variations of an asset sustainability ratio, which summarizes whether an agency is investing sufficiently to maintain asset value and conditions. The city of Melbourne set performance targets of 0.5 for the renewal and upgrade ratio and 1.0 for the capital replacement ratio. Meeting those targets means that the city is investing at a level sufficient to maintain or improve asset value. The table below demonstrates these measures. It shows the actual values from 2016 through 2019, and forecasts values for 2020-2021.

| CAPITAL WORKS PERCENTAGE OF DEPRECIATION | 2016-17 ACTUAL ($'000) | 2017-18 ACTUAL ($'000) | 2018-19 ACTUAL ($'000) | 2019-20 ACTUAL ($'000) | 2020-21 Forecast ($'000) |

|---|---|---|---|---|---|

| Renewal & Upgrade Works | 53,190 | 58,698 | 55,722 | 71,836 | 108,668 |

| Depreciation | 57,717 | 58,507 | 57,889 | 61,048 | 64,658 |

| Renewal & Upgrade / Depreciation Totals | 79% | 86% | 82% | 85% | 168% |

| Five-Year Average | 116% | ||||

| All Capital Works / Depreciation Totals | 136% | 180% | 211% | 202% | 288% |

| Five-Year Average: | 205% |

In addition to calculating asset sustainability ratios based on actual historical data, the city estimates the performance measures for 10 years into the future, predicting depreciation and capital expenditures. This allows the city to better align planned expenditures and needs.

Source: City of Melbourne. City of Melbourne Asset Plan 2021-31. City of Melbourne, 2021. Web access: http://www.melbourne.vic.gov.au/about-council/governance-transparency/policies-protocols/Pages/asset-plan-2021-31.aspx

Carver County Public Works

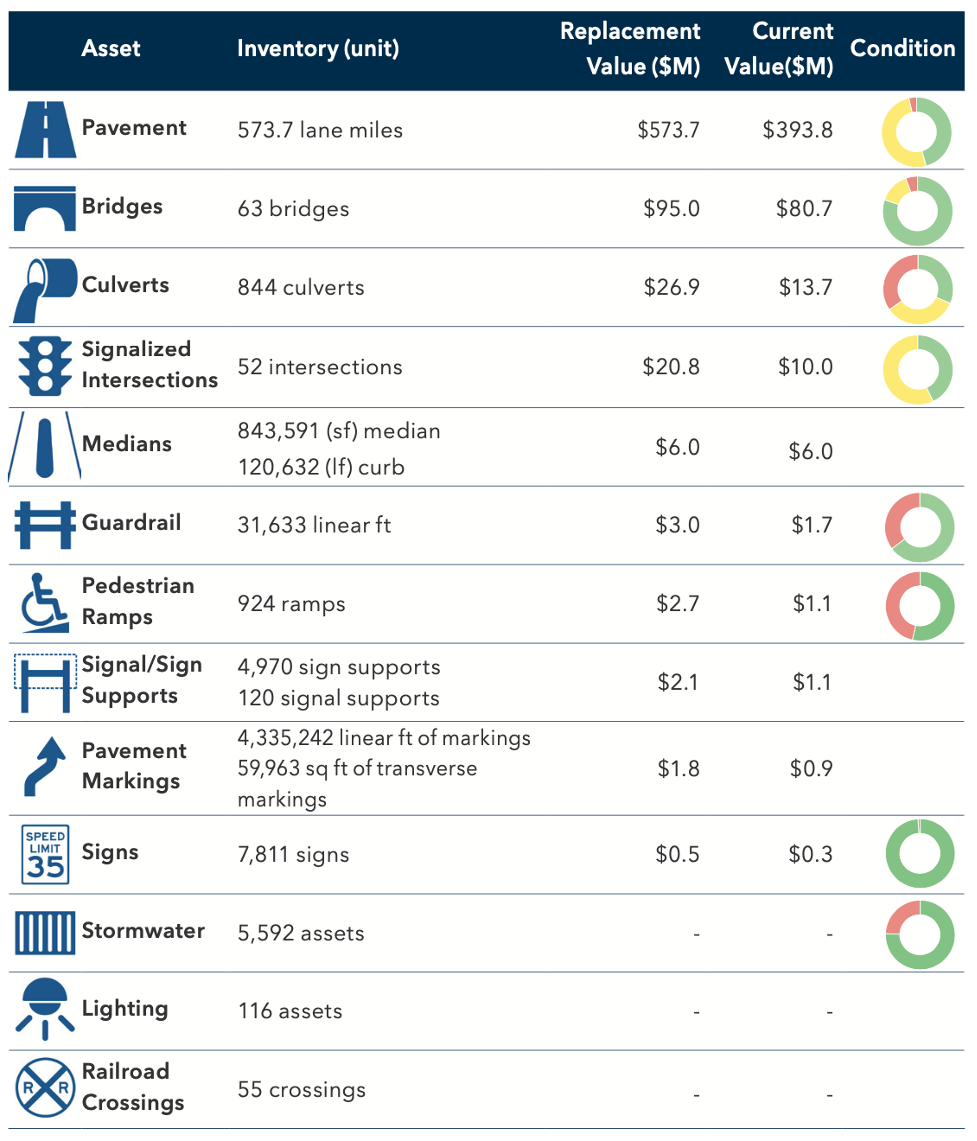

Carver County, located in the Minneapolis-St. Paul metropolitan area, is responsible for managing a variety of transportation assets, including rural and urban roads, intersections, lighting, railroad crossings, and pedestrian crossings. Carver County Public Works captured these assets in a 2021 Transportation Asset Management Plan which uses asset value to communicate the scope and condition of the system.

For each asset, Carver County calculates a replacement value (unit costs * units) and a current value (replacement value – depreciation) using the cost perspective. Due to varying levels of resources and data available for each asset, there are multiple ways that depreciation is calculated, including age-based and condition-based approaches. Some assets use compliance with standards and guidelines (e.g. ADA) as a proxy for condition, which in turn is used to calculate depreciation.

The asset replacement and current values help communicate the state of the county’s asset inventory to the public and provide a financial account of the publicly owned assets.

Source: Carver County Public Works Division. Transportation Asset Management Plan: Carver County. Carver County Public Works Division, 2021.